Printable Version of Topic

Click here to view this topic in its original format

InstaForex | Forex Forum | Forex world | InstaForex Forum _ Traders' discussions _ AceTraderfx : DAILY TECHNICAL OUTLOOK ON Majors

Posted by: acetraderforex Aug 23, 2013, 08:13 AM

DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

23 Aug 2013 00:08GMT

Trend Daily Chart: Sideways

Daily Indicators: Rising

21 HR EMA: 1.5597

55 HR EMA: 1.56620

Trend Hourly Chart: Near term down

Hourly Indicators: Falling

13 HR RSI: 47

14 HR DMI: -ve

Daily Analysis: Consolidation with downside bias

Resistance

1.5753 - Jun 17 high

1.5718 - Wed's high

1.5666 - Wed's NY res

Support

1.5563 - Y'day's low

1.5520 - Last Thur's NY low

1.5496 - Last Thur's Australian low

. GBP/USD - 1.5600 ... The British pound ratcheted lower in Asia n Europe y'day n cable dropped to an intra-day low of 1.5563 on dlr's broad-based strength, however, the pound rebounded briefly to 1.5614 on short-covering after the release of worse-than-expected U.S. jobless claims data b4 trading sideways.

. As mentioned in our previous update, the reversal fm Wed's high at 1.5718 signals recent erratic upmove fm Jul's 3-year low at 1.4814 has formed a temp. top there n as hourly technical indicators are still declining, suggesting a much-needed correction has taken place n as long as 1.5666 (Wed's NY res) holds, choppy consolidation with downside bias remains for further weakness twds 1.5520 sup (last Thur's NY low) but anticipated low readings on hourly oscillators shud limit downside to 1.5483 (38.2% r of 1.5102-1.5718) n yield rebound later.

. Today, selling cable again on intra-day recovery in anticipation of further weakness is favoured n only a breach of 1.5666 res wud signal the pullback is over instead n yield resumption of aforesaid upmove fm 1.4814 to 1.5718, abv wud encourage for re-test of key daily res at 1.5753 (Jun).

Posted by: acetraderforex Aug 28, 2013, 04:01 AM

DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

28 Aug 2013 01:00GMT

Trend Daily Chart: Sideways

Daily Indicators: Turning down

21 HR EMA: 1.5543

55 HR EMA: 1.5558

Trend Hourly Chart: Sideways

Hourly Indicators: Turning up

13 HR RSI: 46

14 HR DMI: +ve

Daily Analysis: Consolidation with upside bias

Resistance

1.5696 - Last Tue's high

1.5638 - Last Fri's high

1.5592 - Y'day's high

Support

1.5482 - Y'day's low

1.5423 -Last Wed's low

1.5392 - Aug 06 high

. GBP/USD - 1.5538 ... Although the pound traded sideways in Asia on Tue, traders gave sterling a broad-based bashing at European open, price easily penetrated last Fir's low 1.5538 n tumbled to 1.5482 at NY open, dlr's renewed weakness due partly to escalation of Middle East tension lifted cable to 1.5556 .

. Cable's rebound fm 1.5582 signals decline fm last Wed's 2-month peak at 1.5718 has made a temporary bottom there as this low was accompanied by 'bullish convergences' on the hourly oscillators n choppy consolidation is envisaged in next 1-2 days. Looking at the bigger picture, sterling's aforesaid retreat fm 1.5718 signals the 3-legged erratic rise fm Jul's 3-year trough at 1.4814 has possibly made a temporary top there n breach of 1.5423 sup wud add credence to this view, then further subsequent weakness to 1.5373 wud be seen, this is a 'minimum' 38.2% r of aforesaid upmove fm 1.4814.

. Today, expect initial sideways trading in Asia n as long as 1.5510/20 holds, upside bias remains for a retracement of the said decline fm 1.5718 twd 1.5612 but res 1.5638 wud cap upside. Below 1.5582 may risk 1.5423 b4 rebound.

Posted by: acetraderforex Sep 2, 2013, 04:13 AM

DAILY EUR/USD OUTLOOK - 1.3203

DAILY EUR/USD OUTLOOK - 1.3203

01 Sep 2013 23:14GMT

Despite euro's brief retreat to 1.3193 in Asian

morning, subsequent rebound suggests the pullback

fm Fri's NY res at 1.3224 has possibly ended n

consolidation abv Fri's low at 1.3173 wud continue

with upside bias for gain to 1.3230 n 1.3255.

For st trade, hold long with stop as indicated,

break wud abrt n risk weakness to 1.3173.

STRATEGY : Sell at 1.3240

OBJECTIVE : 1.3160

STOP-LOSS : 1.3280

RES : 1.3224/1.3255/1.3299

SUP : 1.3173/1.3154/1.3128

Posted by: acetraderforex Sep 6, 2013, 07:51 AM

AceTraderfx Sept 6: Daily Market Outlook on Majors EUR/USD DAILY EUR/USD OUTLOOK - 1.3131

DAILY EUR/USD OUTLOOK - 1.3131

06 Sep 2013 02:13GMT

Despite y'day's selloff to a fresh 6-week low at

1.3110 (NY), intra-day rebound suggests initial con

solidation wud be seen b4 decline fm Aug's peak at

1.3453 resumes twd 1.306, 'loss of momentum' shud

keep price abv 1.3015 n yield correction later.

Exit prev. short n sell again on further recovery

as only abv 1.3173 may risk retrace. twd 1.3223/27.

STRATEGY : Exit short n sell at 1.3150

POSITION : Short at 1.3180

OBJECTIVE : 1.3070

STOP-LOSS : 1.3190

RES : 1.3173/1.3223/1.3255

SUP : 1.3110/1.3066/1.3015

Posted by: acetraderforex Sep 9, 2013, 10:09 AM

AceTraderforex Sept 9 : WEEKLY TECHNICAL OUTLOOK ON GBP/USD WEEKLY TECHNICAL OUTLOOK ON GBP/USD

WEEKLY TECHNICAL OUTLOOK ON GBP/USD

09 Sep 2013 02:00GMT

Trend Daily Chart: Sideways

Daily Indicators: Neutral

21 HR EMA: 1.5620

55 HR EMA: 1.5608

Trend Hourly Chart: Up

Hourly Indicators: Bearish divergences

13 HR RSI: 58

14 HR DMI: +ve

Daily Analysis: Consolidation with upside bias

Resistance

1.5753 - JUn 17 high

1.5718 - Augs' high (21)

1.5681 - Last Fri's high

Support

1.5564 - Last Fri's low

1.5522 - Last Tue's low

1.5462 - Aug 30 low

. GBP/USD - 1.5633... Trading cable proved to be tricky due to its daily large swings last week. Price ratcheted higher fm 1.5507 (Mon) to 1.5681 Fri on dlr's broad-based weakness after U.S. payrolls were less than market forecast.

. Looking at the daily chart, sterling's erratic rise fm 1.5427 signals early retreat fm Aug's peak at 1.5718, although strg, has ended there n abv said res wud extend upmove fm 2013 3-year trough at 1.4814 (Jul) to test chart obj. at 1.5753, abv wud encourage for gain to 1.5781, this is the 'natural' 50% r of the MT fall fm 1.6747 (2011 top), abv needed to extend aforesaid move to 1.5879, being 50% proj. of 1.4814 to 1.5718 measured fm 1.5427. Having said that, as the daily indicators wud display 'bearish divergences' on such move, reckon 1.5986 (61.8% proj. ) wud remain intact. On the downside, only below 1.5522 wud abort abv mildly bullish scenario n may yield re-test of 1.5427 later.

. Today, although sterling's retreat fm said Fri's 1.5681 high in NY sug- gests initial consolidation is in store in Asia, below 1.5564 needed to confirm temp. top is made n yield retrace. twd 1.5522 whilst abv 1.5681 risks 1.5718.

Posted by: acetraderforex Sep 13, 2013, 10:21 AM

AceTraderforex Sept 13, 2013 : DAILY USD/CHF OUTLOOK DAILY USD/CHF OUTLOOK - 0.9324

DAILY USD/CHF OUTLOOK - 0.9324

13 Sep 2013 07:10GMT

Although dlr has recovered after extending fall

fm last Thur's 6-week 0.9455 high to 0.9272 y'day,

as long as 0.9371 holds, aforesaid decline to re-

trace upmove fm Aug's low at 0.9147 shud resume n

extend marginally to 0.9265 (61.8% r).

Trade fm short side for this move with stop abv

0.9371, break risks gain to 0.9395 n 0.9420/30.

STRATEGY : Hold short

POSITION : Short at 0.9340

OBJECTIVE : 0.9270

STOP-LOSS : 0.9375

RES : 0.9335/0.9371/0.9395

SUP : 0.9272/0.9239/0.9206

Posted by: acetraderforex Sep 17, 2013, 08:34 AM

AceTraderForex Sept 17 : DAILY TECHNICAL OUTLOOK ON EUR/USD DAILY TECHNICAL OUTLOOK ON EUR/USD

DAILY TECHNICAL OUTLOOK ON EUR/USD

17 Sep 2013 04:01GMT

Trend Daily Chart

Sideways

Daily Indicators

Neutral

21 HR EMA

1.3341

55 HR EMA

1.3328

Trend Hourly Chart

Sideways

Hourly Indicators

Turning down

13 HR RSI

47

14 HR DMI

0

Daily Analysis

Consolidation b4 upmove resumes

Resistance

1.3453 - Aug 20 high

1.3410 - Aug 23 high

1.3385 - Y'day's high

Support

1.3325 - Sep 11 high

1.3298 - Y'day's low

1.3254 - Last Fri's low

. EUR/USD - 1.3335 ... The single currency jumped to 1.3382 in NZ after WSJ reported that former U.S. Treasury Secretary Lawrence Summers withdrew his nomination for Chairman of the Federal Reserve, euro retreated briefly to 1.3340 b4 rising to 1.3385 but only to fall to 1.3330 near NY close.

. Looking at the hourly & daily charts, although euro's retreat fm y'day's

2-week high at 1.3385 suggests 1-2 days of consolidation wud be seen with initial downside bias, as early rally fm this month's low at 1.3105 signals the

correction fm Aug's 6-month high at 1.3453 has ended there, reckon pullback wud be ltd n as long as 1.3298 sup holds, bullishness remains for aforesaid upmove to resume n extend marginal gain twds 1.3410, however, as 'bearish divergences' wud appear on hourly oscillators on such move, suggesting key daily res at 1.3453 shud hold on 1st testing n yield retreat later.

. Today, buying euro on dips is still favoured in expectation of such rise. On the downside, only a breach of 1.3254 sup (last Fri's low) wud signal top is made n further 'gyration' inside 1.3105-1.3453 wud be seen with downside bias.

Posted by: acetraderforex Sep 18, 2013, 10:44 AM

AceTraderfx Sept 18 : DAILY TECHNICAL OUTLOOK ON USD/CHF DAILY TECHNICAL OUTLOOK ON USD/CHF

DAILY TECHNICAL OUTLOOK ON USD/CHF

18 Sep 2013 00:11GMT

Trend Daily Chart

Sideways

Daily Indicators

Neutral

21 HR EMA

0.9263

55 HR EMA

0.9276

Trend Hourly Chart

Sideways

Hourly Indicators

Turning up

13 HR RSI

47

14 HR DMI

0

Daily Analysis

Consolidation b4 decline resumes

Resistance

0.9371 - Sep 11 high

0.9341 - Last Fri's high

0.9279 - Y'day's high

Support

0.9225 - Mon's NZ low

0.9171 - Aug 27 low

0.9147 - Aug 20 low

. USD/CHF - 0.9258.. Despite dlr's retreat after extending gain fm Mon's 2-

week low at 0.9225 to 0.9279 in Asia y'day, buying of eur/chf cross lifted price

fm 0.9253 in Europe but failure to penetrate said intra-day high prompted

another round of dlr selling in NY morning n price later dropped to 0.9257.

. Looking at the hourly chart, dlr's rebound fm 0.9225 to 0.9279 suggests

decline fm Aug's 0.9455 high has made a minor low there n another day of choppy

sideways trading abv said sup wud be seen, stronger gain twd 0.9298/01 cannot be

ruled out but as the selloff fm 0.9455 indicates correction fm Aug's low at

0.9147 has 'possibly' ended there earlier, suggesting bias for dlr remains to

the downside n measured res at 0.9313 (38.2% r of 0.9455-0.9225) shud hold n

yield decline later this week. A firm breach of 0.9225 wud extend weakness to

0.9171 (Aug 27 low) but as 'bullish converging signals' shud appear on hourly

oscillators on next decline, reckon 0.9147 low wud remain intact on 1st testing.

. In view of abv analysis, selling dlr on intra-day recovery in anticipa-

tion of another fall is still favoured. Only abv 0.9341 signals low, 0.9367/71.

Posted by: acetraderforex Sep 24, 2013, 09:24 AM

AceTraderForex Sept 24 : Daily Market Outlook on Major GBP/USD DAILY GBP/USD OUTLOOK - 1.6029

DAILY GBP/USD OUTLOOK - 1.6029

24 Sep 2013 07:26GMT

Despite sterling's retreat fm 1.6073 to 1.6017 in NY y'day, below said sup needed to signal recovery fm 1.5986 (Fri) has ended n bring resumption of decline fm last Wed's 8-month peak at 1.6163 to 1.5958, 'loss of momentum' wud keep cable abv 1.5920/25.

Sell again on intra-day recovery as only abv 1.6100 indicates pullback is over, risks 1.6142/47.

STRATEGY : Sell at 1.6060

OBJECTIVE : 1.5965

STOP-LOSS : 1.6098

RES : 1.6073/1.6100/1.6163

SUP : 1.6017/1.5986/1.5958

Posted by: acetraderforex Sep 27, 2013, 09:17 AM

AceTraderForex Sept 27 : Daily Outlook on Major GBP/USD DAILY GBP/USD OUTLOOK - 1.6092

DAILY GBP/USD OUTLOOK - 1.6092

27 Sep 2013 07:04GMT

Cable's intra-day spike to 1.6133 after media

report of hawkish comments by BoE's Carney suggests

correction fm last Wed's 8-month peak at 1.6163 has

ended at 1.5955 n abv said res wud extend MT upmove

fm 1.4814 to 1.6188, then twd 1.6255 next week.

Hold long for 1.6160 1st n only below 1.6043 pro

longs choppy consolidation, risks 1.5999/04.

STRATEGY : Hold long

POSITION : Long at 1.6090

OBJECTIVE : 1.6160

STOP-LOSS : 1.6055

RES : 1.6163/1.6188/1.6255

SUP : 1.6043/1.5999/1.5955

Posted by: acetraderforex Oct 3, 2013, 06:05 AM

![]() AceTraderFx Oct 3: Forex Market Outlook on Majors GBP/USD

AceTraderFx Oct 3: Forex Market Outlook on Majors GBP/USD MEDIUM TERM OUTLOOK on GBP/USD - 1.6175

MEDIUM TERM OUTLOOK on GBP/USD - 1.6175

02 Oct 2013 04:19GMT

Cable's rally abv 1.5753 (Jun) to a fresh 9-month high at 1.6260 confirms MT uptrend fm this year's low at 1.4814 (Apr) has resumed n further gain to 1.6380 res (Jan) is likely, abv wud extend to 1.6500 but 1.6747 res wud hold fm here.

Only below 1.5955 wud signal a temporary top is made n risk stronger retrace- ment to 1.5753 (prev. res, now sup) b4 rebound.

Posted by: acetraderforex Oct 4, 2013, 08:45 AM

![]() AceTraderFx Oct 4 : Daily market outlook on EUR/USD

AceTraderFx Oct 4 : Daily market outlook on EUR/USD DAILY MARKET OUTLOOK : EUR/USD - 1.3625

DAILY MARKET OUTLOOK : EUR/USD - 1.3625

04 Oct 2013 00:53 GMT

Yesterday's rise to a fresh near 8-month high at 1.3646 suggests medium term rise from April's low at 1.2745 would extend towards 1.3657/60 after initial consolidation, however, near term loss of momentum would prevent strong rise above there and reckon resistance at 1.3711 would limit upside and bring a much-needed correction later.

On the downside, only below 1.3577 would indicate a temporary top has been made and risk would shift to the downside for a retracement to 1.3505.

Posted by: acetraderforex Oct 7, 2013, 09:38 AM

AceTraderFx Oct 7: Daily Market Outlook on EUR/USD DAILY MARKET OUTLOOK on EUR/USD - 1.3565

DAILY MARKET OUTLOOK on EUR/USD - 1.3565

07 Oct 2013 00:38 GMT

Euro's strong retreat from last Wednesday's near 8-month high at 1.3646 to 1.3538 on Friday suggests medium-term uptrend has made a temporary top over there and consolidation with downside bias would be seen for a stronger retracement to 1.3505 but good support at 1.3462 would remain intact and yield rebound later.

On the upside, only above 1.3607 would indicate aforesaid pullback has ended and yield re-test of said high, break extends rise to 1.3679/80.

Posted by: acetraderforex Oct 7, 2013, 10:13 AM

![]() AceTraderFx Oct 7 : Daily outlook on Asian Exotic – USD/IDR

AceTraderFx Oct 7 : Daily outlook on Asian Exotic – USD/IDR USD/IDR DAILY OUTLOOK - 11530

USD/IDR DAILY OUTLOOK - 11530

07 Oct 2013 07:52GMT

Although usd has retreated fm last Mon's peak at

11660 n consolidation is seen, as long as sup 11505

holds, upside bias remains to re-test said res.

Hold long with stop as indicated, below wud

risk stronger retracement twd 11455 n 11430.

STRATEGY : Long at 11520

POSITION : Long at 11520

OBJECTIVE : 11610

STOP-LOSS : 11480

RES : 11660/11700/11750

SUP : 11505/11455/11430

Posted by: acetraderforex Oct 8, 2013, 08:47 AM

![]() AceTraderFx Oct 8 : Daily Outlook on EUR/USD

AceTraderFx Oct 8 : Daily Outlook on EUR/USD DAILY MARKET OUTLOOK EUR/USD - 1.3565

DAILY MARKET OUTLOOK EUR/USD - 1.3565

08 Oct 2013 06:58 GMT

Although y'day's rebound fm 1.3543 to 1.3585 sug

gests euro's 'choppy' trading abv last Fri's low at

1.3538 wud continue, as long as 1.3607 res holds,

corrective fall fm last Thur's 8-mth peak at 1.3646

wud extend to 1.3500 but 1.3462 shud remain intact.

Hold short for this move with stop abv 1.3607,

break may risk re-test of 1.3646, then 1.3660.

STRATEGY : Hold short

POSITION : Short at 1.3580

OBJECTIVE : 1.3500

STOP-LOSS : 1.3610

RES : 1.3591/1.3607/1.3646

SUP : 1.3538/1.3505/1.3462

Posted by: acetraderforex Oct 10, 2013, 08:56 AM

![]() AceTraderFx Oct 10: DAILY TECHNICAL OUTLOOK ON GBP/USD

AceTraderFx Oct 10: DAILY TECHNICAL OUTLOOK ON GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

10 Oct 2013 03:18GMT

Trend Daily Chart : Sideways

Daily Indicators : Turning down

21 HR EMA :1.5977

55 HR EMA :1.6023

Trend Hourly Chart : Down

Hourly Indicators : Rising fm o/s

13 HR RSI : 37

14 HR DMI : -ve

Daily Analysis : Consolidation b4 one more fall

Resistance

1.6070 - Tue's NY low

1.6006 Last Fri's low

1.5968 - Y'day NY res

Support

1.5916 - Y'day's low

1.5886 - Sep 17 low

1.5844 - 50% r of 1.5427-1.6260

. GBP/USD - 1.5960..Cable's traded wildly initially y'day as news of nomin-

ation of Fed Vice Chair Yellen as next Fed Chief led to a bout of dlr-buying in

Aust., price bounced to 1.6122 but quickly fell in Asia. Intra-day fall accele-

rated after weaker-than-expected U.K. prod. data n cable tanked to 1.5916 in NY.

. Y'day's selloff to 1.5916 has justified our weekly bearish view that MT

rise fm Jul's 3-year low at 1.4814 has made a top last week at 1.6260 (Tue) n as

indicated in previous update, cable's aforesaid fall fm 1.6260 is at least cor-

recing MT intermediate rise fm 1.5427, since price has already reached the 'mini

mum' 38.2% r obj. at 1.5942, next downside target is pointing at the 'natural'

50% r obj. at 1.5844, a daily close below there wud turn outlook even more bear-

ish for further selloff to 1.5708 (38.2% r of 1.4814-1.6260).

. Today, the o/n rebound fm y'day's post-FOMC low at 1.5916 suggests the

pound wud gain some respite in Asia n range trading is in store, as price is tra

ding below the 21-hr & 55-hr emas, downside bias remains for decline fm 1.6260

to extend twd next chart obj. at 1.5886 but 1.5844 shud remain intact.

Posted by: acetraderforex Oct 15, 2013, 10:34 AM

AceTraderFx Octr 15 : DAILY TECHNICAL OUTLOOK ON GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

15 Oct 2013 00:51GMT

Trend Daily Chart :Sideways

Daily Indicators :Turning down

21 HR EMA :1.5982

55 HR EMA :1.5980

Trend Hourly Chart :Sideways

Hourly Indicators :Neutral

13 HR RSI :41

14 HR DMI :-ve

Daily Analysis : Consolidation b4 one more fall

Resistance

1.6070 - Last Tue's NY low

1.6046 - 38.2% r of 1.6260-1.5914

1.6018 - Y'day's high

Support

1.5914 - Last Thur's low

1.5886 - Sep 17 low

1.5844 - 50% r of 1.5427-1.6260

. GBP/USD - 1.5968 ... Trading cable proved to be tricky y'day as despite

initial weakness to 1.5955 in European morning, renewed buying lifted the pair n

to a session high at 1.6018 in NY morning. However, the British pound pared its

gains and dropped to 1.5979 in NY afternoon n then 1.5966 ahead of Asian open.

. Despite y'day's rebound to 1.6018, as mentioned in previous updates,

cable's early fall below 1.6006 sup (now res) to 1.5914 last Thur suggests MT

rise fm Jul's 3-year low at 1.4814 has made a top at 1.6260 n as long as 1.6046

(38.2% r of 1.6260-1.5914) holds, downside bias remains for said fall fm 1.6260

to at least correct the MT intermediate upmove fm 1.5427 n yield weakness to 50%

r target at 1.5844, a daily close below there wud retain bearish scenario for

further losses twd 1.5708 (38.2% r of 1.4814-1.6260). On the upside, abv 1.6046

res wud abort bearishness n risk stronger gain to 1.6076 (last Tue's NY low) but

res at 1.6122/24 shud remain intact.

. Today, in view of aforementioned bearish scenario, selling cable on intra-

day recovery for a re-test of sup 1.5914 is favoured. .png)

Posted by: acetraderforex Oct 17, 2013, 08:36 AM

![]() AceTraderFx Oct 17 : DAILY TECHNICAL OUTLOOK ON USD/CHF

AceTraderFx Oct 17 : DAILY TECHNICAL OUTLOOK ON USD/CHF DAILY TECHNICAL OUTLOOK ON USD/CHF

DAILY TECHNICAL OUTLOOK ON USD/CHF

17 Oct 2013 00:21GMT

Trend Daily Chart : Down

Daily Indicators : Falling

21 HR EMA : 0.9137

55 HR EMA : 0.9129

Trend Hourly Chart : Sideways

Hourly Indicators : Neutral

13 HR RSI : 53

14 HR DMI : 0

Daily Analysis : Choppy trading to continue

Resistance

0.9279 - Sep 17 high

0.9225 - Sep 15 low, now res

0.9178 - Tue's high

Support

0.9093 - Tue's low

0.9064 - Mon's low

0.9016 - Last Mon's n Tue's low

USD/CHF - 0.9140 ... U.S. dollar went through a 'roller-coaster' session

y'day. Despite Tue's rally to a fresh 4-week high at 0.9178, price retreated to

0.9118 in Australian morning y'day n then 0.9098 in NY morning due to U.S. debt

deadlock b4 rebounding to 0.9175 after U.S. Senate reached a bipartisan deal.

. Looking at the hourly n daily charts, as mentioned in our previous

updates, dlr's firmness suggests erratic upmove fm Oct's 19-month low at 0.8968

to at least retrace MT intermediate downtrend fm 0.9455 (Sep's high) remains in

progress n as long as Mon's low at 0.9064 holds, mild upside bias remains for

further gain to 0.9212, (being 50% r of 0.9455-0.8968), however, anticipated

high readings on hourly oscillators wud prevent strg gain abv 0.9225 (Sep 15

low, now res) n reckon 0.9269 (61.8% r) shud cap upside n yield retreat later.

. Today, we're standing aside in the meantime n wud look to buy dlr on dips

as only a breach of 0.9064 sup wud violate recent series of higher lows n higher

highs fm 0.8968 n signal aforesaid corrective rise has made a top there n yield

weakness twds 0.9016 sup (last Mon's n Tue's low).

Posted by: acetraderforex Oct 24, 2013, 09:20 AM

![]() AceTraderFx Oct 24 : DAILY TECHNICAL OUTLOOK ON GBP/USD

AceTraderFx Oct 24 : DAILY TECHNICAL OUTLOOK ON GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

24 Oct 2013 01:03GMT

Trend Daily Chart : Up

Daily Indicators : Neutral

21 HR EMA : 1.6172

55 HR EMA : 1.6172

Trend Hourly Chart : Sideways

Hourly Indicators : Rising fm o/s

13 HR RSI : 43

14 HR DMI : -ve

Daily Analysis : Consolidation b4 marginal fall

Resistance

1.6260 - 01 Oct high

1.6225 - Last Fri's high

1.6181 - Mon's high

Support

1.6119 - Y'day's low

1.6064 - Last Wed's high, now sup

1.6010 - Last Tue's high, now sup

. GBP/USD - 1.6195... Despite edging higher to 1.6258 in Asian morning on

Wed, failure to penetrate Oct's 1.6260 top triggered profit-taking. Cable tanked

in early European morning b4 extending fall to session low of 1.6119 after MPC

minutes. The pound later pared its losses n rebounded to 1.6176 in NY afternoon.

. Looking at the hourly n daily charts, as y'day's rise to 1.6258 was accom-

panied by bearish divergences on the hourly indicators, subsequent selloff to

1.6119, which also happened to be the minimum 38.2% r of 1.5894-1.6258 suggests

price wud consolidate below Oct's 1.6260 top n choppy trading with downside bias

remains. However, as mentioned in our previous update, cable's rally fm 1.5894

signals upmove fm Jul's 3-year trough at 1.4814 has resumed n abv 1.6260 wud

extend to 1.6310/11 (Sep 2012 peak n 50% proj. of 1.5427-1.6260 measured fm

1.5894 respectively) but price wud hold well below 2013 peak at 1.6380.

. Today, we are holding a short position in anticipation of weakness to

1.6100 but 1.6076 (50% r of 1.5894-1.6258) shud hold. Only a daily close abv

1.6225 wud confirm correction fm 1.6258 is over, yields 1.6258/60. .png)

Posted by: acetraderforex Oct 25, 2013, 08:58 AM

![]() AceTraderFx Oct 25 : DAILY TECHNICAL OUTLOOK ON GBP/USD

AceTraderFx Oct 25 : DAILY TECHNICAL OUTLOOK ON GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

25 Oct 2013 00:47GMT

Trend Daily Chart : Up

Daily Indicators : Neutral

21 HR EMA : 1.6189

55 HR EMA : 1.6182

Trend Hourly Chart : Sideways

Hourly Indicators : Neutral

13 HR RSI : 55

14 HR DMI : -ve

Daily Analysis : Consolidation b4 marginal fall

Resistance

1.6310 - Sep 21 2012 high

1.6260 - 01 Oct high

1.6223 - Y'day's high

Support

1.6119 - Y'day's low

1.6064 - Last Wed's high, now sup

1.6010 - Last Tue's high, now sup

. GBP/USD - 1.6187... The British pound proved to be a little tricky to trade

y'day as despite initial bounce to 1.6223 in European morning, price retreated

sharply to 1.6138 at NY open. However, cable pared its losses n staged a strg

recovery to 1.6213 in NY afternoon b4 falling again at Asian open.

. Y'day's choppy trading suggests price wud be confined inside nr term range

of 1.6119-1.6258 for today n consolidation with mild downside bias wud be seen

but said lower lvl wud hold. Looking at the bigger picture, as mentioned in our

previous update, cable's rally fm 1.5894 to 1.6258 on Wed signals upmove fm

Jul's 3-year trough at 1.4814 wud resume soon n abv Oct's peak at 1.6260 wud

extend gain to 1.6310/11 (Sep 2012 peak n 50% proj. of 1.5427-1.6260 measured fm

1.5894 respectively) next week/early Nov but price wud hold well below 2013 peak

at 1.6380 due to loss of momentum.

. Today, we are holding a short position in anticipation of a re-test of

y'day's low at 1.6138 but sup at 1.6116/19 shud hold n yield rebound. Only a

daily close abv 1.6223 wud abort near term bearish bias on the pound. .png)

Posted by: acetraderforex Oct 28, 2013, 10:38 AM

![]() AceTraderFx Oct 28 : WEEKLY TECHNICAL OUTLOOK ON USD/JPY

AceTraderFx Oct 28 : WEEKLY TECHNICAL OUTLOOK ON USD/JPY WEEKLY TECHNICAL OUTLOOK ON USD/JPY

WEEKLY TECHNICAL OUTLOOK ON USD/JPY

27 Oct 2013 23:44GMT

Trend Daily Chart : Sideways

Daily Indicators : Turning down

21 HR EMA : 97.41

55 HR EMA : 97.42

Trend Hourly Chart : Sideways

Hourly Indicators : Rising

13 HR RSI : 56

14 HR DMI : +ve

Daily Analysis : Choppy trading to continue

Resistance

98.19 - Last Wed's high

97.86 - Last Wed's NY low. now res

97.78 - Intra-day high in Aust.

Support

97.15 - Last Wed's low

96.94 - Last Fri's low

96.55 - Oct 07 low

. USD/JPY - 97.51 ... Despite initial cross-inspired recovery to 98.48 on

Tue due to rebound in the N225, sudden spike in Chinese short-term rates spoofed investors n caused a slide in the N225, traders bot yen broadly as safe-haven currency, pushing the pair to a 2-week low of 96.94 Fri b4 staging a recovery.

. Let's look at the bigger picture 1st, dlr's recent broad sideways move is

set to continue for rest of this week as price wud remain confined recent established range of 95.81-100.62 n only a daily close abv or below either side wud signal a major 'breakout' has taken place, so until then, one shud not too excited when price is approaching twd the upper or lower level of aforesaid range. On the downside, below 95.81 wud be 1st signal downside break has occured n test of 93.75 (reaction fm 2013 4-1/2 year peak at 103.74) wud follow in Nov/Dec. Only abv 99.01 wud shift risk to upside n yield subsequent rebound twd 100.62.

. Today, intra-day gap-up open to 97.78 in Aust. suggests decline fm 99.01 has made a low n 1-2 days of consolidation is seen with upside bias but 98.22 (61.8% r) shud cap present rise n yield another fall later.

Posted by: acetraderforex Oct 30, 2013, 10:17 AM

AceTraderFx Oct 30 : DAILY TECHNICAL OUTLOOK ON EUR/USD

DAILY TECHNICAL OUTLOOK ON EUR/USD

DAILY TECHNICAL OUTLOOK ON EUR/USD

30 Oct 2013 00:16GMT

Trend Daily Chart : Up

Daily Indicators : Overbought

21 HR EMA : 1.3758

55 HR EMA : 1.3774

Trend Hourly Chart :Near term down

Hourly Indicators : Oversold

13 HR RSI : 36

14 HR DMI : -ve

Daily Analysis : Consolidation with downside bias

Resistance

1.3883 - 100% proj. of 1.3472-1.3704 fm 1.3651

1.3833 - Last Fri's near 2-year high

1.3813 - Y'day's high

Support

1.3736 - Y'day's low

1.3711 - Feb 01 high

1.3651 - Oct 21 low

. EUR/USD - 1.3735 ... The single currency ratcheted lower in Asia n Europe y'day n price weakened to 1.3754 near NY open b4 rebounding swiftly but sharply to 1.3813 in NY morning after euro-positive comments fm ECB's Nowotny, then fall to session low at 1.3736 b4 trading sideways.

. Y'day's firm break of previous 1.3741 sup to 1.3736 suggests MT upmove fm 1.2042 (2012 trough) has possibly made a temporary top at 1.3833 (exactly 61.8% r of 1.4940-1.2042) last Fri n as price is currently trading below 21-hr n 55-hr emas (now at 1.3758 n 1.3774 respectively), suggesting as long as res at 1.3813 (y'day's high) holds, consolidation with downside bias remains for weakness to 1.3704/11 (Oct 18 high n Feb high resp.), however, low readings on the hourly oscillators shud keep price abv 1.3651/53 (being Oct 21 low n 50% r of intermediate rise fm 1.3472-1.3833 resp.).

. Today, selling on intra-day recovery in anticipation of a stronger cor-

rection to 1.3695 is favoured. Only abv 1.3833 wud confirm MT uptrend has once again resumed n extend twd 1.3883 (100% proj. of 1.3472-1.3704 fm 1.3651).

Posted by: acetraderforex Nov 1, 2013, 09:51 AM

![]() AceTraderFx Nov 1 : DAILY TECHNICAL OUTLOOK ON GBP/USD

AceTraderFx Nov 1 : DAILY TECHNICAL OUTLOOK ON GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

01 Nov 2013 01:34GMT

Trend Daily Chart Sideways

Daily Indicators Turning down

21 HR EMA 1.6041

55 HR EMA 1.6053

Trend Hourly Chart Near term down

Hourly Indicators Neutral

13 HR RSI 49

14 HR DMI -ve

Daily Analysis Consolidation with downside bias

Resistance

1.6165 - Hourly res, Oct 28

1.6119 - Last Wed's low, now res

1.6079 - Y'day's high

Support

1.5999 - Y'day's low

1.5940 - Oct 17 low

1.5894 - Oct 16 low

. GBP/USD - 1.6025... Despite initial weakness to 1.6006 ahead of European opening, failure to penetrate Wed's low at 1.5999 prompted active short-covering n price rebounded to 1.6070 due to cross-buying of gbp vs eur in NY morning. However, renewed selling interest pushed cable back down to 1.6031 nr NY close.

. The outlook remains pretty much the same as our prev. update. Looking at the daily n hourly charts, this week's selloff to 1.5999 (Wed) suggests near

term rise fm 1.5894 (Oct 16 low) has ended at 1.6258 last Wed n consolidation below Oct's near 9-month high at 1.6260 wud continue with downside bias. The price action fm 1.6260 cud also be unfolding into a triangle (a-leg at 1.5894, b-leg 1.6258 n present decline is the c-leg), if this view holds true, then then 2-3 more weeks of choppy sideways trading is in store.

. Today, in view of abovementioned scenario, we are holding short for weakness to 1.5975, however, 1.5964 (80.9% r of 1.4894-1.6258) wud hold n yield recovery. On the upside, only abv 1.6119 wud abort bearishness on the pound n risk stronger gain to 1.6165 next week.

*** T.G.I.F. *** .png)

Posted by: acetraderforex Nov 4, 2013, 10:29 AM

![]() AceTraderFx Nov 4: Weekly Technical Outlook on GBP/USD

AceTraderFx Nov 4: Weekly Technical Outlook on GBP/USD  WEEKLY TECHNICAL OUTLOOK ON GBP/USD

WEEKLY TECHNICAL OUTLOOK ON GBP/USD

03 Nov 2013 23:53GMT

Trend Daily Chart: Sideways

Daily Indicators: Turning down

21 HR EMA :1.5955

55 HR EMA : 1.5998

Trend Hourly Chart : Near term down

Hourly Indicators : Rising fm o/s

13 HR RSI : 27

14 HR DMI : -ve

Daily Analysis : Consolidation with downside bias

Resistance

1.6040 - Last Fri's European high

1.5999 - Last Wed's low

1.5953 - Last Fri's European low

Support

1.5894 - Oct's low (16th)

1.5818 - 38.2% r of 1.5102-1.6260

1.5753 - -Jun 17 high

. GBP/USD - 1.5923 ... Although cable also fell in tandem with eur/usd last week, active selling of eur/gbp cross limited sterling's downside some what, price weakened to a fresh 2-week low of 1.5908 on Fri.

. Looking at the daily chart, despite the recent volatile broad sideways

move inside recent 1.5894-1.6260 range, anticipated selloff in the euro suggests cable wud also come under selling pressure in this week, a breach of 1.5894 wud confirm MT rise fm 2013 3-year trough at 1.4814 (Jul) has indeed formed a top earlier at 1.6260 on the 1st day of Oct n correction of the intermediate rally fm 1.5102 wud knock the pound to 1.5818, being a 'minimum' 38.2% r, a daily close below there wud send price lower twd 1.5681 (50% r) later this month. In view of abv bearish scenario, selling cable on recovery is favoured n only a daily close abv 1.6079 wud prolong consolidation, risk 1.6119/24.

. Today, expect initial sideways trading in Asia as Tokyo market is closed

n reckon 1.5953 wud cap intra-day recovery n yield test of said daily sup at

1.5894, break wud extend recent erratic fall to 1.5840/50.

Posted by: acetraderforex Nov 5, 2013, 11:02 AM

![]() AceTraderFx Nov 5 : Daily Technical Outlook on USD/CHF

AceTraderFx Nov 5 : Daily Technical Outlook on USD/CHF DAILY TECHNICAL OUTLOOK ON USD/CHF

DAILY TECHNICAL OUTLOOK ON USD/CHF

05 Nov 2013 00:04GMT

Trend Daily Chart : Sideways

Daily Indicators :Turning up

21 HR EMA :0.9109

55 HR EMA :0.9085

Trend Hourly Chart : Sideways

Hourly Indicators : Neutral

13 HR RSI : 41

14 HR DMI : -ve

Daily Analysis :Consolidation b4 upmove resumes

Resistance

0.9225 - Sep 16 low

0.9178 - Oct 15 high

0.9152 - Y'day's Asian high

Support

0.9091 - Y'day's NY low

0.9071 - Last Fri's European low

0.9024 -Last Thur's high

USD/CHF - 0.9100 ... The pair also extended recent upmove fm Oct's 23-

month low at 0.8891 to a fresh 2-week high at 0.9152 y'day due to dlr's broad-based strength, however, active profit-taking capped dlr's upside n the pair ratcheted lower to a session low at 0.9091 near NY close.

. Despite y'day's brief rise to 0.9152, subsequent retreat suggests 1-2

days of consolidation wud be seen b4 upmove fm Oct's near 2-year trough of 0.88 91 to retrace MT downtrend to resume, abv 0.9152 wud bring further gain to 0.91 73/78, being 50% r of intermediate fall fm 0.9455-0.8891 n Oct 15 high respectively. Looking at the bigger picture, only a daily close abv 0.9178 res wud encourage for further gain to 0.9240 (61.8% r of 0.9455-0.8891) n possibly twd 0.9253, this is 38.2% r of intermediate decline fm 0.9839 (2013 top in May) n then twd 0.9365 (50% r).

. Today, buying on intra-day retreat in anticipation of subsequent upmove is favoured n only a breach of 0.9024 (Oct 30 high, now sup) wud signal temp. top is made n may risk stronger correction to 0.8991/93 n possibly 0.8952 sup.

Posted by: acetraderforex Nov 8, 2013, 10:56 AM

![]() AceTraderFx Nov 8 : Daily Technical Outlook on USD/CHF

AceTraderFx Nov 8 : Daily Technical Outlook on USD/CHF DAILY TECHNICAL OUTLOOK ON USD/CHF

DAILY TECHNICAL OUTLOOK ON USD/CHF

08 Nov 2013 00:25GMT

Trend Daily Chart :Sideways

Daily Indicators : Rising up

21 HR EMA : 0.9157

55 HR EMA : 0.9139

Trend Hourly Chart : Up

Hourly Indicators : Falling fm o/bot

13 HR RSI : 56

14 HR DMI : +ve

Daily Analysis : Choppy consolidation to take place

Resistance

0.9304 - 38.2% r of 0.9972-0.8891

0.9251 - Y'day's high

0.9217 - Y'day's hourly res

Support

0.9134 - Y'day's NY low

0.9098 - Wed's low

0.9024 - Last Thur's high

. USD/CHF - 0.9168 ... The pair tracked eur/usd's movement very closely in inverse manner on Thur. Despite dlr's rally to 0.9251 due to the selloff in euro after ECB's rate cut, profit-taking capped dlr's upside n price fell sharply to 0.9151 on renewed risk aversion due to the selloff in U.S. equities.

. Looking at the hourly n daily charts, despite y'day's resumption of upmove fm Oct's near 2-year trough of 0.8891 to 0.9251 to retrace MT downtrend fm 0.99 72 (July 2012), the subsequent strg retreat strongly suggests a temporary top is in place n sevel days of choppy consolidation is in store b4 prospect of another leg of upmove occurs later next week, below 0.9134 (reaction low fm 0.9251) wud add credence to this view, however, 0.9071, being a 'natural' 50% r of the entire rise fm 0.8891 as well as chart sup, wud contain weakness. Looking ahead, abv 0.9251 wud extend subsequent headway twd 0.9365 (50% r of intermediate fall fm 0.9839-08891).

. Today, we're trading dlr on both sides of the market n will sell on intra

-day recovery or buy on next decline in anticipation of another rebound.

Posted by: acetraderforex Nov 15, 2013, 10:34 AM

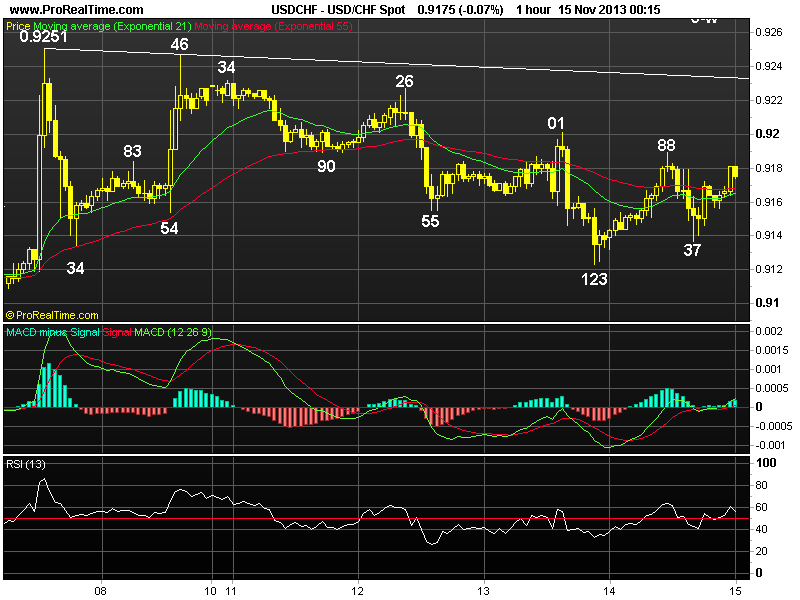

![]() AceTraderFx Nov 15 : Daily Technical Outlook on USD/CHF

AceTraderFx Nov 15 : Daily Technical Outlook on USD/CHF  DAILY TECHNICAL OUTLOOK ON USD/CHF

DAILY TECHNICAL OUTLOOK ON USD/CHF

15 Nov 2013

Trend Daily Chart : Up

Daily Indicators : Rising

21 HR EMA : 0.9166

55 HR EMA : 0.9168

Trend Hourly Chart : Sideways

Hourly Indicators : Rising

13 HR RSI : 59

14 HR DMI : +ve

Daily Analysis : Choppy trading to continue

Resistance

0.9251 - Last Thur's 6-week high

0.9226 - Tue's high

0.9201 - Wed's high

Support

0.9123 - Wed's late NY low

0.9091 - Last Mon's low

0.9029 - 61.8% r of 0.8891-0.9251

. USD/CHF - 0.9178 ... Despite staging a brief bounce fm Wed's low at 0.9123 to 0.9189 on Thur, renewed selling interest below Wed's high at 0.9201 pressured price to 0.9137 in NY morning after Thur's testimony by Fed's vice chair Janet Yellen. The pair then rebounded to 0.9172 b4 trading sideways.

. Looking at the daily chart, as mentioned in our previous update, Wed's

breach of 0.9134 to 0.9123 suggests upmove fm Oct's 23-month low at 0.8891 has made a 6-week high at 0.9251 last Thur n marginal weakness twds 0.9113 (38.2% r of 0.8891-0.9251) cannot be ruled out but reckon 0.9091/98 sup area wud contain downside n yield rebound later. On the upside, a breach of res at 0.9201 (Wed's high) wud confirm the correction is over n yield resumption of the Oct's rise fm 0.8891 to retrace MT downtrend fm 2012 peak at 0.9972 (Jul) to re-test 0.9246/51 res area, abv wud extend to 0.9304 (38.2% r of MT fall fm 0.9972-0.8891).

. Today, buying dlr on next decline in anticipation of a rebound is still

favoured. On the downside, only a daily close below 0.9091 wud risk stronger

retracement to 0.9024/29 (prev. res, now sup n 61.8% r fm 0.8891 resp.).

Posted by: acetraderforex Nov 18, 2013, 10:01 AM

![]() AceTraderFx Nov 18 : </b>GBP/USD Elliott Wave analysis (weekly)

AceTraderFx Nov 18 : </b>GBP/USD Elliott Wave analysis (weekly) 'WEEKLY' ELLIOTT WAVE ANALYSIS ON GBP/USD

'WEEKLY' ELLIOTT WAVE ANALYSIS ON GBP/USD

15 Nov 2013 16:02GMT

. GBP/USD - 1.6091 ... Despite cable's impulsive rally fm Jul's 3-year low at 1.4814 to as high as 1.6260, subsequent retreat to 1.5854 suggests minor consolidation wud be seen b4 rising further to 1.6380 res n possibly twds 1.6491 later, however, key daily res at 1.6747 shud hold on 1st testing.

. Let's recap the previous count, decline fm 2012 Apr's peak at 1.6747

marked the terminus of a triangle C-leg (see the larger degree wave count

below), D-leg:1.6747-1.5234 n E-leg:1.5234-1.6380, subsequent selloff fm there has developed into a 3-legged decline n has ended at 1.4814 in July, current rally fm there is impulsive with wave 1.4814-1.5435: 2:1.5102 n wave 3 is now unfolding n gain to 1.6344/80 (2 times ext. of 1.4814-1.5435 measured fm 1.5102 n chart res), abv wud encourage for further rise to 1.6491 (2.236 times extension) but 1.6728/47 (2.618 times extension n 2012 Apr's peak) wud hold.

On the downside, only below 1.5718/53 (prev. sup, now res) wud signal a temporary top is made n risk stronger retracement twds Sep's low at 1.5427.

------------------- *** LARGER DEGREE WAVE COUNT *** ---------------------------

21 NOV 2011... Cable's 3-legged rise fm 1985 record low of 1.0370 signals an (A) - ( B ) - ( C ) wave has completed at 2.1162 (07'), the subsequent impulsive decline is an x-wave with wave (3) bottom at 1.3500, the choppy consolidation fm there is turning into a triangle with A-1.7044, B-1.4228, C-1.6747, D-leg is either ended at 1.5234 or may extend weakness to 1.4690-1.4781 area.

Posted by: acetraderforex Nov 19, 2013, 10:08 AM

![]() AceTraderFx Nov 19 : Intra-Day Outlook on Major USD/JPY

AceTraderFx Nov 19 : Intra-Day Outlook on Major USD/JPY Intra-Day USD/JPY Outlook

Intra-Day USD/JPY Outlook

19 Nov 2013 08:05 GMT

As dlr has fall again after recovering fm 99.57

to 99.93, suggesting downside bias remains for the

decline fm last Fri's 2-month peak at 100.43 to

resume soon for marginal weakness but nr term loss

of momentum shud keep price abv 99.35.

Lower short entry for 99.50, stop as indicated,

abv wud defer but res at 100.20 shud remain intact.

Rate

99.72

Strategy/Entry Level

Sell at 99.90

Objective

99.50

Stop-Loss

100.10

Range Forecast

99.57 / 99.90

Resistance

R: 99.96 /100.20/100.43

Support

S: 99.57 / 99.35/ 99.10

Posted by: acetraderforex Nov 21, 2013, 10:12 AM

![]() AceTraderFx Nov 21: Daily Technical Outlook on GBP/USD

AceTraderFx Nov 21: Daily Technical Outlook on GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

21 Nov 2013 00:22GMT

Trend Daily Chart

Sideways

Daily Indicators

Rising

21 HR EMA

1.6120

55 HR EMA

1.6116

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

40

14 HR DMI

-ve

Daily Analysis

Consolidation with downside bias

Resistance

1.6208 - Oct 28 high

1.6178 - Y'day's high

1.63149 - Mon's high

Support

1.6060 - Tue's low

1.6048 - Last Fri's low

1.5988 - Last Thur's low

. GBP/USD - 1.6088.. Despite initial bounce to 1.6143 in Aust. Wed, price

retreated to 1.6104 at European open. However, cable rose after BoE minutes signalled the U.K. economy is recovering n price to climbed a 3-week high of 1.6178 in NY b4 tanking to 1.6087 after release of mildly hawkish FOMC minutes.

. Y'day's decline fm 1.6178 to 1.6087 strongly suggests cable's near term upmove fm Nov's near 2-month low at 1.5854 has made a top there n further choppy trading below 2013 peak at 1.6260 (Oct) wud be seen with downside bias, below 1.6060 sup wud add credence to this view n bring weakness to next chart sup at 1.6048, however, as hourly oscillators' readings wud be in o/sold territory on such move, reckon 1.6016 (this is a 'natural' 50% r of aforesaid rise fm 1.5854- 1.6178) wud contain weakness n bring subsequent rebound.

. Today, anticipated usd's broad-based strength shud weigh on the pound n selling cable on intra-day recovery is therefore recommended, however, profit shud be taken on subsequent decline. On the upside, only abv 1.6149/54 res wud dampen bearishness on cable n may risk re-test of 1.6178 but 1.6208 shud hold.

Posted by: acetraderforex Nov 22, 2013, 11:09 AM

![]() AceTraderFx Nov 22 : Daily Technical Outlook on USD/CHF

AceTraderFx Nov 22 : Daily Technical Outlook on USD/CHF DAILY TECHNICAL OUTLOOK ON USD/CHF

DAILY TECHNICAL OUTLOOK ON USD/CHF

22 Nov 2013 00:34GMT

Trend Daily Chart

Sideways

Daily Indicators

Neutral

21 HR EMA

0.9150

55 HR EMA

0.9146

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

44

14 HR DMI

-ve

Daily Analysis

Consolidation with a neutral bias

Resistance

0.9251 - Nov's high (7th)

0.9226 - Last Tue's high

0.9194 - Wed's high

Support

0.9123 - Wed's European high

0.9080 - Wed's low (Aust.)

0.9029 - 61.8% r of 0.8891-0.9251

. USD/CHF - 0.9142 ... Despite initial firmness in Asia y'day following a

strg rally fm 0.9080 to as high as 0.9194 on Wed, dlr failed to re-test 0.9194 n fell in Europe due to intra-day rebound in eur/usd, dlr fell to 0.9128 in NY,

then marginally to 0.9125 in Aust. today b4 staging a recovery at Asian open.

. Looking at the daily chart, although Wed's strg bounce fm 0.9080 to 0.9194 signals correction fm Nov's 6-week peak at 0.9251 has ended n re-test of this res lvl is envisaged next week, abv there wud confirm the MT rise fm 2013 trough at 0.8891 (Oct) has once again resumed, then gain to 0.9304 wud be seen later this month, being a 'minimum' 38.2% r of the MT 3-legged fall fm 0.9972 (2012 peak in Jul)to 0.8891. Having said that, dlr's aforesaid retreat fm 0.9194 to 0.9125 earlier today suggests choppy consolidation wud be seen b4 prospect of subsequent resumption of aforesaid upmove.

. Today, although dlr's rebound fm 0.9125 signals erratic fall fm 0.9194

has made a low, abv NY high at 0.9165 is needed to turn outlook bullish for re

test of 0.9194, then twd 0.9226. Below 0.9123/25 may risk weakness twd 0.9080.

Posted by: acetraderforex Nov 25, 2013, 09:34 AM

![]() AceTraderFx Nov 25: Weekly Outlook on GBP/USD

AceTraderFx Nov 25: Weekly Outlook on GBP/USD WEEKLY GBP/USD OUTLOOK - 1.6228

WEEKLY GBP/USD OUTLOOK - 1.6228

25 Nov 2013 03:38GMT

Cable's rally abv res at 1.6178 (now sup) has

turned outlook bullish for a re-test of Oct's high

at 1.6260, abv there wud extend MT rise fm Jul's 3-

year trough at 1.4814 twd 2013 peak at 1.6380 (Jan)

but break there needed to yield further headway twd

next projected target at 1.6433 in Dec.

Turn long on dips in anticipation of such a move

n only below 1.6109 signals temp. top is in place,

risks weakness to 1.6072 n possibly twd 1.6000.

STRATEGY : Buy at 1.6195

OBJECTIVE : 1.6350

STOP-LOSS : 1.6140

RES : 1.6260/1.6380/1.6433

SUP : 1.6178/1.6072/1.5988

Posted by: acetraderforex Nov 28, 2013, 03:32 AM

![]() AceTraderFx Nov 28: ELLIOTT WAVE ANALYSIS- weekly on USD/JPY

AceTraderFx Nov 28: ELLIOTT WAVE ANALYSIS- weekly on USD/JPY WEEKLY ELLIOTT WAVE ANALYSIS ON USD/JPY

WEEKLY ELLIOTT WAVE ANALYSIS ON USD/JPY

27 Nov 2013 13:09GMT

. USD/JPY - 101.78 ... U.S. dollar found renewed buying at 96.55 in Oct n rallied abv 100.62 (Sep's high) n 101.53 (Jul's high), suggesting the triangle-like consolidation fm this year's high at 103.74 (May) has possibly ended earlier at 93.78 in Jun n LT rise fm record low at 79.75 shud resume for re-test of aforesaid key daily res at 103.74 later, possibly in Dec.

. Our labelling of the low at 79.75 major wave [3] trough n 147.64 is the

major wave [4] terminus. The decline fm 147.64 is the 'final' wave [5] which has 'possibly' ended at 75.32 in Oct 2011, the subsequent rally is an impulsive wave with 1::75.32-84.18; 2:77.13 n we are taking the view that wave 3 has ended at 103.74 n wave 4, which developed into a triangle with a:103.74-93.78, b:101.53, c:95.79: d:100.62 n e:96.55 n wave 5 is now in progress n a re-test of 103.74 wud be seen soon, abv wud extend gain to 105.00 later.

On the downside, only below 99.00/01 wud suggest wave 4 is still

developing n may bring another drop to 96.55 but renewed buying shud emerge well abv key daily sup at 93.78 (Jun's low).

------------------- *** LARGER DEGREE WAVE COUNT *** ---------------------------

17 NOV 2011..The break of 79.75 (95') signals this was the major wave [3] trough n wave [4] ended at 147.64 (Jul 98), subsequent erratic fall is wave [5] which is unfolding into diagonal A-B-C-D-E : A-101.25, B-124.14, current C-wave is a 3-legged move with (a.) wave trough at 87.10, (b.) wave top at 101.45 n (c.) 75.32 ?

Posted by: acetraderforex Dec 9, 2013, 04:47 AM

![]() AceTraderFx Dec 9: Weekly Technical analysis on Major

AceTraderFx Dec 9: Weekly Technical analysis on Major WEEKLY USD/JPY OUTLOOK

WEEKLY USD/JPY OUTLOOK

09 Dec 2013 00:16GMT

Trend Daily Chart

Up

Daily Indicators

Rising

21 HR EMA

102.69

55 HR EMA

102.44

Trend Hourly Chart

Up

Hourly Indicators

O/bot

13 HR RSI

76

14 HR DMI

+ve

Daily Analysis

Consolidation with upside bias

Resistance

104.51 50% proj. of 97.60-103.38 fm 101.62

103.74 - 2013 peak (May 2)

103.38 - Last Tue's 6-month high

Support

102.44 - Last Thur's high

102.21 - Last Fri's European morning high

101.62 - Last Thur's low

. USD/JPY - 103.08... Although the greenback ratcheted lower initially last week after climbing to a 6-month high of 103.38 (Tue), decline in the Nikkei fm 6-year highs prompted broad-based buying of yen n pressured price to 101.62 b4 rallying strongly back to 102.97 on Fri, n then 103.22 in Australia today.

. Looking at the daily picture, as indicated in previous update, dlr's close

abv 102.84 res Fri signals correction fm 103.74 is over n the pair is posied to

re-test 2013 4-1/2 year peak at 103.74 (May), break there wud confirm LT uptrend fm 2011 record low at 75.32 (Oct) has finally resumed, then the pair is en route twd 107.96 in Q1 2014, being 50% proj. of 75.32-103.74 measured fm 93.75. This week, abv 103.74 wud extend initial gain to 104.51 (50% proj. of MT intermediate rise fm 97.60-103.38 fm 101.62 but 105.19 (61.8% proj.) wud cap upside. Only below 102.21 wud dampen bullishness n risk retracement twd 101.15.

. Today, as current price is abv the 21-hr n 55-hr emas, suggesting dlr

wud head to 103.38 1st, break wud encourage for subsequent re-test of said 2013

peak n only below 102.41/44 aborts intra-day bullishness on dlr. .png)

Posted by: acetraderforex Dec 20, 2013, 04:32 AM

![]() AceTraderFx 20: WEEKLY ELLIOTT WAVE ANALYSIS ON USD/JPY

AceTraderFx 20: WEEKLY ELLIOTT WAVE ANALYSIS ON USD/JPY WEEKLY ELLIOTT WAVE ANALYSIS ON USD/JPY

WEEKLY ELLIOTT WAVE ANALYSIS ON USD/JPY

19 Dec 2013 15:44GMT

. USD/JPY - 104.15 ... Dollar's rally abv this year's high at 103.74 (May)

confirms an upside break of the 'triangle' consolidation fm there has ended

earlier at 93.75 n LT rise fm record low at 75.32 (Oct 2011) has resumed for

further gain to 105.51 n then twds 107.06 in Q1 2014.

. Our labelling of the low at 79.75 major wave [3] trough n 147.64 is the

major wave [4] terminus. The decline fm 147.64 is the 'final' wave [5] which has

'possibly' ended at 75.32 in Oct 2011, the subsequent rally is an impulsive wave

with 1::75.32-84.18; 2:77.13 n we are taking the view that wave 3 has ended at

103.74 n wave 4 ended with a triangle with a:103.74-93.78, b:101.53, c:95.79:

d:100.62 n e:96.55 n wave 5 is now in progress for further gain to 107.06, being

50% projection of 77.13-103.74 measured fm 93.75 later this month or in Q1 2014.

On the downside, only below 101.53 (b-leg top) wud signal a temp. top is

made n risk retrace. to 100.00 but strg buying interest shud emerge well abv

daily sup at 96.55.

Posted by: acetraderforex Dec 27, 2013, 04:30 AM

![]() AceTraderFx Dec 27: Daily Outlook on Major USD/JPY

AceTraderFx Dec 27: Daily Outlook on Major USD/JPY DAILY USD/JPY OUTLOOK - 104.81

DAILY USD/JPY OUTLOOK - 104.81

26 Dec 2013 23:25GMT

Dlr's firmness after y'day's rise to a fresh 5-

year peak at 104.85 suggests LT uptrend wud extend

gain to 105.00 after initial consolidation, break

there wud bring subsequent headway twds projected

obj. at 105.15/20 but reckon 105.40/50 wud hold.

Buy on dips with stop as indicated, below wud

abort n risk stronger retracement to 103.77.

STRATEGY : Buy at 104.45

OBJECTIVE : 105.20

STOP-LOSS : 104.10

RES : 105.00/105.43/105.91

SUP : 104.64/104.12/103.77

Posted by: acetraderforex Jan 2, 2014, 04:49 AM

![]() AceTraderFx Jan 2, 2013: Weekly market outlook on USD/JPY

AceTraderFx Jan 2, 2013: Weekly market outlook on USD/JPY WEEKLY USD/JPY OUTLOOK - 105.31

WEEKLY USD/JPY OUTLOOK - 105.31

31 Dec 2013 05:46GMT

Dlr's intra-day resumption upmove to a fresh 5-

year peak of 105.41 suggests uptrend fm 2011 record

low at 75.32 wud head twd 106.23, however, o/bot

condition shud prevent strg gain this week n reckon

projected res at 107.06 shud cap upside, risk has

increased for a correction to occur in Jan 2014.

Still favour buying dlr on dips for this move n

only below 103.77 confirms temporary top is finally

in place, risks stronger retracement twd 102.50.

STRATEGY : Buy at market

OBJECTIVE : 106.55

STOP-LOSS : 104.60

RES : 105.41/106.23/107.06

SUP : 104.64/103.77/102.50

Posted by: acetraderforex Jan 20, 2014, 04:31 AM

![]() AceTraderFx Jan 20 : Intraday Market Outlook on USD/JPY

AceTraderFx Jan 20 : Intraday Market Outlook on USD/JPY INTRA-DAY USD/JPY OUTLOOK - 104.04

INTRA-DAY USD/JPY OUTLOOK - 104.04

20 Jan 2014 02:04GMT

Although initial cross-buying of yen pushed dlr

below prev. sup at 104.15 (Thur) to 103.87 in Asia,

present rebound suggests erratic fall fm 104.92

(Thur) has possibly made a temp. low n choppy conso

lidation is seen, abv 104.21 wud yield 104.35/40.

Stand aside n sell dlr on further rise to 104.40

or buy on next decline to 103.80.

Posted by: acetraderforex Jan 21, 2014, 03:22 AM

![]() AceTraderFx Jan 21: Intra-day Recommendations on USD/JPY

AceTraderFx Jan 21: Intra-day Recommendations on USD/JPY INTRA-DAY Outlook on USD/JPY - 104.52

INTRA-DAY Outlook on USD/JPY - 104.52

21 Jan 2014 01:25 GMT

Dlr's present firm breach of Mon's European top at 104.26 strongly suggests early pullback fm last Thur's high at 104.92 has ended y'day at 103.86 n consolidation with upside bias remains for further gain twd 104.66 but 104.92 shud hold in Asia.

Posted by: acetraderforex Jan 27, 2014, 03:32 AM

![]() AceTraderFx Jan 27: Daily Outlook on Major USD/JPY

AceTraderFx Jan 27: Daily Outlook on Major USD/JPY Daily Recommendations on Major USD/JPY

Daily Recommendations on Major USD/JPY

27 Jan 2014 00:26 GMT

DAILY OUTLOOK ON USD/JPY - 102.27

Intra-day selloff below Fri's low at 102.00 to 101.77 on Monday suggests corrective fall fm Jan's 5-year peak at 105.45 remains in progress n down- side bias remains for weakness to 101.62, then 101. 30/35 but sup 101.14/15 wud hold n yield rebound.

Posted by: acetraderforex Jan 28, 2014, 03:21 AM

![]() AceTraderFx Jan 28: Daily Outlook on Major USD/JPY

AceTraderFx Jan 28: Daily Outlook on Major USD/JPY  Daily Recommendations on USD/JPY

Daily Recommendations on USD/JPY

28 Jan 2014 00:07 GMT

DAILY OUTLOOK ON USD/JPY - 102.55

Although USD's rebound from Mon's 7-week bottom of 101.77 to 102.93 signals recent fall from Jan's 5-yr peak at 105.45 has made a minor low,

subsequent retreat to 102.20 in NY suggests as long as 102.93 holds, decline would resume to 101.62, then 101.40.

Posted by: acetraderforex Jan 30, 2014, 09:08 AM

![]() AceTraderFx Jan 30 : Daily Technical Outlook on Major EUR/USD

AceTraderFx Jan 30 : Daily Technical Outlook on Major EUR/USD DAILY TECHNICAL OUTLOOK ON EUR/USD

DAILY TECHNICAL OUTLOOK ON EUR/USD

30 Jan 2014 01:01GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning up

21 HR EMA

1.3659

55 HR EMA

1.3661

Trend Hourly Chart

Sideways

Hourly Indicators

Neutral

13 HR RSI

50

14 HR DMI

-ve

Daily Analysis

Consolidation with mild upside bias

Resistance

1.3740 - Last Fri's high

1.3716 - Mon's high

1.3688 - Tue's high

Support

1.3603 - Y'day's low

1.3584 - Last Wed's high, now sup

1.3508 - Jan 20 low

. EUR/USD - 1.3662 ... The single currency went through a 'roller-coaster'

session on Wed. Despite a brief bounce to 1.3685 in Europe, euro retreated after

failing to penetrate previous res area at 1.3686/89 n then tumbled to session

low of 1.3603 in NY morning b4 rebounding to 1.3677 ahead of FOMC.

. Despite y'day's brief breach of indicated sup at 1.3625 to 1.3603, subse

quent bounce to 1.3677 suggests further 'choppy' consolidation abv last Mon's 7-

week trough at 1.3508 wud be seen n as long as said y'day's low holds, upside

bias still remains. However, a firm breach of 1.3686/89 is needed to signal the

pullback fm last Fri's high at 1.3740 has ended there n extend upmove to 1.3716

(Mon's high), abv suggesst upmove fm 1.3508 has resumed n yield re-test of 1.37

40 (Fri's high), abv wud bring subsequent headway to 1.3812/33, break confirms

correction fm Dec's 2-year peak at 1.3894 has indeed ended n yield re-test of

said res next week.

. In view of abv analysis, buying euro on dips in anticipation of another

rebound is cautiously favoured. On the downside, only a daily close below 1.3584

(last Wed's high, now sup) signals recovery fm 1.3508 is over, 1.3530, 1.3508..png)

Posted by: acetraderforex Feb 4, 2014, 09:01 AM

![]() AceTraderFx Feb 4: Daily Technical Market Outlook on Major USD/JPY

AceTraderFx Feb 4: Daily Technical Market Outlook on Major USD/JPY DAILY USD/JPY TECHNICAL OUTLOOK

DAILY USD/JPY TECHNICAL OUTLOOK

04 Feb 2014 00:14GMT

Trend Daily Chart

Falling

Daily Indicators

Falling

21 HR EMA

101.47

55 HR EMA

101.91

Trend Hourly Chart

Falling

Hourly Indicators

Rising fm o/s

13 HR RSI

36

14 HR DMI

-ve

Daily Analysis

Resumption of recent decline

Resistance

102.41 - Last Fri's NY high

102.14 - Y'day's NY high

101.77 - Last Mon's low, now res

Support

100.77 - Y'day's NY low

100.62 - Sep 11 2013 high

100.30 - Equality proj. of 104.92-101.77 fm 103.45

. USD/JPY - 101.18... Despite dlr's recovery fm 101.98 (NZ) to 102.41 in

Asia on Mon, broad-based buying of yen on risk aversion pressured price below

last Mon's 7-week low at 101.77 to 101.67 in Europe. Later, dlr tumbled to 100.

77 in NY after release of disappointing U.S. ISM manuf. report b4 recovering.

. Looking at the daily chart, y'day's sharp selloff below 101.77 to 100.77

confirms decline fm Jan's 5-year peak at 105.45 to retrace intermediate MT rise

fm 95.81 (Aug low in 2013) has resumed n despite subsequent recovery, as price

is still trading below both 21-hr n 55-hr emas, suggesting bias for dlr remains

to the downside, a breach of said sup shud send dlr lower to next downside obj.

at 100.30, being equality projection of intermediate fall fm 104.92-101.77 mea-

sured fm 103.45, however, a daily close below there is needed to retain bearish

prospect of further losses twd 99.60 (50% r fm 93.75) later this week.

. In view of abv analysis, selling dlr on intra-day recovery in anticipation

of aforesaid fall is favoured n only abv 102.14 (y'day's NY morning high) wud

indicate a temporary low is made n may risk stronger retracement to 102.41,

being y'day's n as well as last Fri's NY high, b4 down. .png)

Posted by: acetraderforex Feb 5, 2014, 03:19 AM

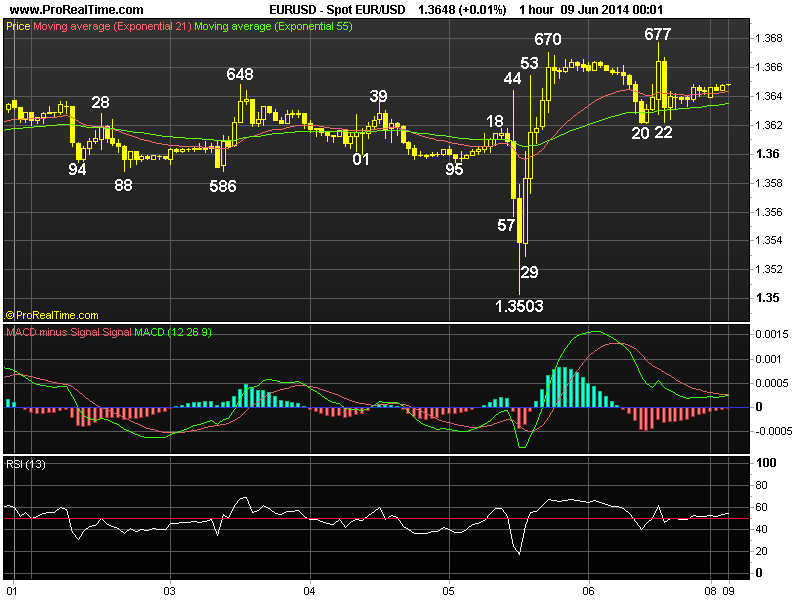

![]() AceTraderFx Feb 5: Daily Market Outlook on Major EUR/USD

AceTraderFx Feb 5: Daily Market Outlook on Major EUR/USD DAILY MARKET OUTLOOK EUR/USD - 1.3520

DAILY MARKET OUTLOOK EUR/USD - 1.3520

05 Feb 2014 01:06 GMT

The single currency rebounds from Monday's low at 1.3477 to 1.3539 on Tuesday suggests choppy trading would be seen but as long as resistance at 1.3574 holds.

Daily bearishness remains for another sell-off later this week, breach of said support would indicate decline from December's 2-year peak at 1.3894 has once again resumed and then further weakness to 1.3455 and 1.3410/20 would follow.

On the upside, only a daily close above 1.3603/09 would shift risk to upside instead for stronger retracement to 1.3640/50 and possibly 1.3685/88.

Posted by: acetraderforex Feb 6, 2014, 03:48 AM

![]() AceTraderFx Feb 6: Daily Market Outlook on Major – EUR/USD

AceTraderFx Feb 6: Daily Market Outlook on Major – EUR/USD DAILY MARKET OUTLOOK EUR/USD - 1.3531

DAILY MARKET OUTLOOK EUR/USD - 1.3531

06 Feb 2014 01:10 GMT

Despite euro's volatile trading on Wednesday, as price has retreated after being capped below yesterday's New York morning high of 1.3555, suggesting recovery from Monday's 2-month low at 1.3477 has ended there and consolidation with downside bias remains, however, breach of said support is needed to confirm decline from December's 2-year peak at 1.3894 has resumed and extend weakness to next retracement objective at 1.3455 and later towards 1.3399.

On the upside, only a firm breach of chart resistance at 1.3574 would confirm a temporary low is in place and turn outlook mildly bullishness instead for gain to 1.3603/09 and then 1.3640

Posted by: acetraderforex Feb 7, 2014, 04:07 AM

![]() AceTraderFx Feb 7: Daily Market Outlook on Major EUR/USD

AceTraderFx Feb 7: Daily Market Outlook on Major EUR/USD DAILY MARKET OUTLOOK EUR/USD - 1.3590

DAILY MARKET OUTLOOK EUR/USD - 1.3590

Update Time: 07 Feb 2014 01:35 GMT

Yesterday rally from 1.3482 to 1.3619 on Thursday after ECB'S President Mario Draghi refraining from any additional stimulus measures announcement signals decline from December's 2-year peak at 1.3894 has made a temporary low earlier at Monday's 2-month trough at 1.3477.

Consolidation with upside bias remains, above said overnight resistance at 1.3619 would bring stronger retracement to 1.3640 and then 1.3665/70, however, near term over bought condition should cap price below chart res sat 1.3686 and yield retreat later.

On the downside, only a daily close below 1.3508 (previous daily support level) would indicate aforesaid correction is over instead and bring re-test of 1.3477, break, 1.3455 and then towards 1.3399.

Posted by: acetraderforex Feb 11, 2014, 03:59 AM

![]() AceTraderFx Feb 11: Daily Market Outlook on Major – USD/EUR

AceTraderFx Feb 11: Daily Market Outlook on Major – USD/EUR DAILY MARKET OUTLOOK EUR/USD - 1.3667

DAILY MARKET OUTLOOK EUR/USD - 1.3667

Update Time: 11 Feb 2014 01:40 GMT

Euro's intra-day rally above yesterday's high at 1.3652 to 1.3678 suggests near term rise from last Monday's trough at 1.3477 to retrace decline from December's 2-year peak at 1.3894 remains in progress and further gain to 1.3685/88, then 1.3716 would be seen, however, near term loss of momentum would keep price well below resistance at 1.3740 and yield retreat later.

On the downside, only below 1.3576 would indicate a temporary top has been made and bring stronger correction towards 1.3552.

Posted by: acetraderforex Feb 19, 2014, 09:18 AM

![]() AceTraderFx Feb 19: Daily Technical Outlook on Major – USD/CHF

AceTraderFx Feb 19: Daily Technical Outlook on Major – USD/CHF DAILY USD/CHF TECHNICAL OUTLOOK

DAILY USD/CHF TECHNICAL OUTLOOK

Last Update At 19 Feb 2014 00:12GMT

Trend Daily Chart

Down

Daily Indicators

Falling

21 HR EMA

0.8891

55 HR EMA

0.8907

Trend Hourly Chart

Down

Hourly Indicators

Bullish convergences

13 HR RSI

29

14 HR DMI

-ve

Daily Analysis

Resumption of recent decline

Resistance

0.9038 - last Wed's high

0.8989 - last Tue's high

0.8949 - last Thur's NY res

Support

0.8870 - Y'day's low

0.8860 - Dec 30 low

0.8800 - Dec 27 low

. USD/CHF - 0.8879... Despite dlr's recovery fm Monday's low at 0.8900 to

0.8929 in Asia on Tuesday, intra-day rally in euro together with selling in

eur/chf cross pressured price lower in Europe n dlr later fell to a fresh 6-week

trough at 0.8870 in NY morning b4 stabilizing.

. Looking at the hourly n daily charts, y'day's fall below Mon's low at

0.8900 to 0.8870 suggests bias for dlr remains to the downside n decline fm

Jan's peak at 0.9156 shud pressure price further to 0.8860 n then 0.8832, being

Dec 30 low n Dec 17 low respectively, after consolidation. However, as hourly

oscillators wud display prominent bullish convergences on such move, sharp fall

below there is unlikely to be seen n reckon Dec's 2-year low at 0.8800 wud hold

on 1st testing n yield minor correction later this week. Looking ahead, a daily

close below 0.8800 wud confirm MT downtrend fm 2012 peak at 0.9972 has 'finally'

resumed n extend weakness twd 0.8700 in late Feb/early Mar.

. In view of abv analysis, selling dlr on intra-day recovery is still

favored today but one shud take profit on next decline. On the upside, only abv

0.8949 wud indicate a temporary low has been made n risk retracement to 0.8989. .png)

Posted by: acetraderforex Feb 20, 2014, 09:41 AM

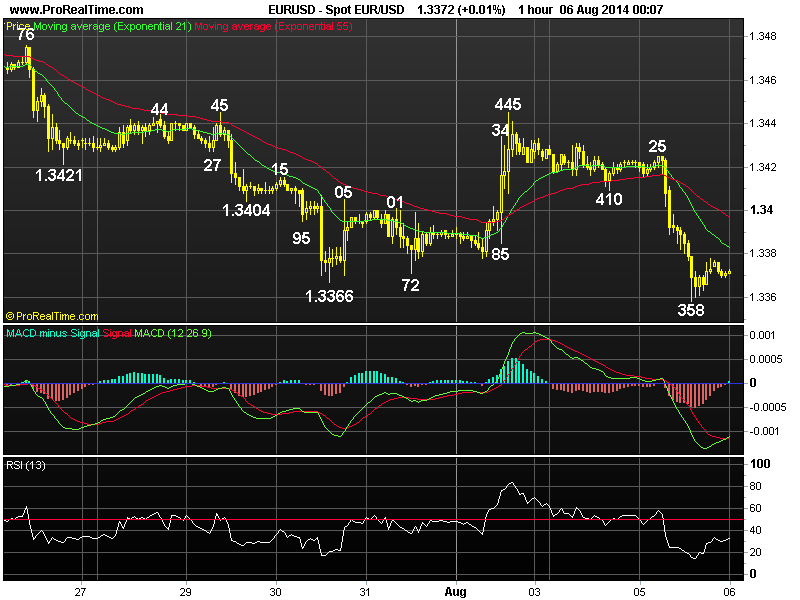

![]() AceTraderFx Feb 20: Daily Technical Outlook on Major – GBP/USD

AceTraderFx Feb 20: Daily Technical Outlook on Major – GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

Update At 20 Feb 2014 00:51GMT

Trend Daily Chart

Up

Daily Indicators

Rising

21 HR EMA

1.6689

55 HR EMA

1.6693

Trend Hourly Chart

Sideways

Hourly Indicators

Neutral

13 HR RSI

44

14 HR DMI

-ve

Daily Analysis

Initial decline b4 rebound

Resistance

1.6823 - Mon's fresh 4-year high

1.6796 - Hourly chart

1.6742 - Tue's high

Support

1.6637 - Y'day's low

1.6600 - Hourly chart

1.6558 - Prev. res, now sup

. GBP/USD - 1.6678... Despite cable's brief rebound to 1.6734 in European

morning y'ay, price tumbled to 1.6660 after higher-than-expected U.K. unemploy-

ment rate n then to 1.6537 ahead of NY open. Later, cable recovered on short-

covering to 1.6725 in NY morning b4 falling again after FOMC minutes.

. Looking at the hourly n daily charts, y'day's firm breach of Tue's low

at 1.6655 to 1.6637 confirms corrective decline fm Mon's 4-year peak at 1.6823

has resumed n as long as res area at 1.6734/42 (y'day's high n Tue's high)

holds, downside bias remains for aforesaid fall to retrace MT uptrend fm 2013

bottom at 1.4814 (Jul) to extend marginally, however, as houly oscillators'

readings wud display 'bullish convergences' on next decline, reckon 1.6600/05,

hourly chart lvl n the 'minimum' 38.2% r of intermediate rise fm 1.6252-1.6823,

wud contain weakness n yield rebound later.

. In view of abv analysis, although selling cable on intra-day recovery is

favoured, day traders shud buy the pound on next decline. On the upside, a daily

close abv the said res area at 1.6724-42 wud be the 1st signal correction is

over n yield further gain twd 1.6796, then re-test of 1.623 next week.

Posted by: acetraderforex Feb 24, 2014, 04:04 AM

![]() AceTraderFx Feb 24: Daily Market Outlook on Major - EUR/USD

AceTraderFx Feb 24: Daily Market Outlook on Major - EUR/USD DAILY MARKET OUTLOOK EUR/USD - 1.3739

DAILY MARKET OUTLOOK EUR/USD - 1.3739

Update Time: 24 Feb 2014 00:33 GMT

Despite Friday's brief but sharp rebound to 1.3758, subsequent retreat to 1.3720 suggests initial consolidation would be seen and marginal weakness from here cannot be ruled out, however, support at 1.3702 should contain downside and yield strong rebound later today. Above 1.3758 would retain bullishness for a re-test of last week's high at 1.3773, break would extend gain towards 1.3819/20.

On the downside, only below 1.3685 would abort intra-day bullish view and risk stronger retracement of rise from February's low at 1.3477 towards 1.3619.

Posted by: acetraderforex Feb 26, 2014, 04:13 AM

![]() AceTraderFx Feb 26: Daily Recommendations on Major - USD/JPY

AceTraderFx Feb 26: Daily Recommendations on Major - USD/JPY DAILY OUTLOOK ON USD/JPY - 102.19

DAILY OUTLOOK ON USD/JPY - 102.19

Update Time: 25 Feb 2014 23:27 GMT

Yesterday's weakness to 102.01 suggests erratic rise from Feb's 10-week trough at 100.76 has made a temp. top at 102.83 last Fri and as long as res area 102.63 /68 holds, downside bias remains for a stronger re- tracement to 101.67 but sup 101.38 would hold.

Posted by: acetraderforex Feb 27, 2014, 08:47 AM

![]() AceTraderFx Feb 27: Daily Technical Outlook on Major – USD/CHF

AceTraderFx Feb 27: Daily Technical Outlook on Major – USD/CHF DAILY USD/CHF TECHNICAL OUTLOOK

DAILY USD/CHF TECHNICAL OUTLOOK

27 Feb 2014 00:28GMT

Trend Daily Chart

Sideways

Daily Indicators

Falling

21 HR EMA

0.8899

55 HR EMA

0.8889

Trend Hourly Chart

Nr term up

Hourly Indicators

Easing fm o/bot

13 HR RSI

63

14 HR DMI

+ve

Daily Analysis

Consolidation with upside bias

Resistance

0.8989 - Feb 11 top

0.8967 - Min. 38.2% r of 0.9156-0.9050

0.8930 - Y'day's low

Support

0.8892 - Tue's high (now sup)

0.8850 - Mon's low

0.8800 - Dec 2-year low (27th)

. USD/CHF - 0.8910... Although dlr traded sideways after finding sup at

0.8867 in Asia on Wed, price started to ratchet higher in Europe due to euro's

intra-day weakness. Later, dlr rallied to 0.8930 in NY morning as U.S. Jan new

home sales rose unexpectedly b4 retreating to 0.8904 near NY close.

. Looking at hourly n daily charts, y'day's breach of indicated res at

0.8910/15 (Mon's high n Feb's 20 high respectively) confirms decline fm Jan's

peak at 0.9156 has formed a temporary bottom at Mon's 8-week trough at 0.8850 n

as long as this sup holds, consolidation with upside bias remains for gain twd

0.8967, being 'minimum' 38.2% r of 0.9156-0.8850, however, as hourly oscillators

wud be in o/bot territory on such a move, measured res at 0.8993/03, 61.8% r of

intermediate fall fm 0.9082-0.8850 n also a 'natural' 50% r of aforesaid entire

decline respectively, shud hold n yield strg retreat later.

. In view of abv analysis, buying dlr on intra-day pullback is favoured but

one shud be prudent to take profit twd 0.8960/70. On the downside, only a break

below 0.8850 sup wud revive early bearishness instead for subsequent weakness

twd Dec's 2-year trough at 0.8800 tom or early next week..png)

Posted by: acetraderforex Feb 28, 2014, 09:37 AM

![]() AceTraderFx Feb 28 : Daily Technical Outlook on Major – GBP/USD

AceTraderFx Feb 28 : Daily Technical Outlook on Major – GBP/USD DAILY TECHNICAL OUTLOOK ON GBP/USD

DAILY TECHNICAL OUTLOOK ON GBP/USD

Last Update At 28 Feb 2014 01:21GMT

Trend Daily Chart

Up

Daily Indicators

Rising

21 HR EMA

1.6677

55 HR EMA

1.6671

Trend Hourly Chart

Sideways

Hourly Indicators

Rising

13 HR RSI

63

14 HR DMI

+ve

Daily Analysis

Consolidation with upside bias

Resistance

1.6823 - Last Mon's 4-year high

1.6776 - Last Mon's NZ res

1.6728 - Tue's high

Support

1.6617 - Y'day's low

1.6583 - Mon's low

1.6537 - 50% r of 1.6252-1.6823

. GBP/USD - 1.6691 ... The British pound continued to fluctuate wildly on Thur. Although cable weakened fm Asian high at 1.6683 to 1.6617 in European morning, renewed buying interest there lifted price n sterling later rallied back to 1.6699 after dovish remarks by Fed Chair Janet Yellen b4 stabilising.

. Despite y'day's brief drop below Wed's low at 1.6622 to 1.6617, cable's

subsequent rebound after holding well abv Mon's low at 1.6583 suggests further 'choppy' sideways trading inside near term established broad range of 1.6583- 1.6728 wud continue with upside bias for gain to 1.6728 res (Tue's high), however, break is needed to signal the corrective fall fm last Mon's 4-year peak at 1.6823 has indeed ended at 1.6583 (Mon) n a daily close abv 1.6734/42, Feb 19 high n Feb 18 top respectively wud add credence to this view n yield possible resumption of MT uptrend for re-test of 1.6823 later next week.

. Today, we're holding a long position in anticipation of further gain. On

the downside, only below 1.6617 wud shift risk to the downside for a re-test of Mon's low at 1.6583, below wud bring stronger retracement of MT intermediate fm rise 1.6252 twd 1.6537 (being 50% r of 1.6252-1.6823) b4 prospect of recovery.

Posted by: acetraderforex Mar 3, 2014, 10:05 AM

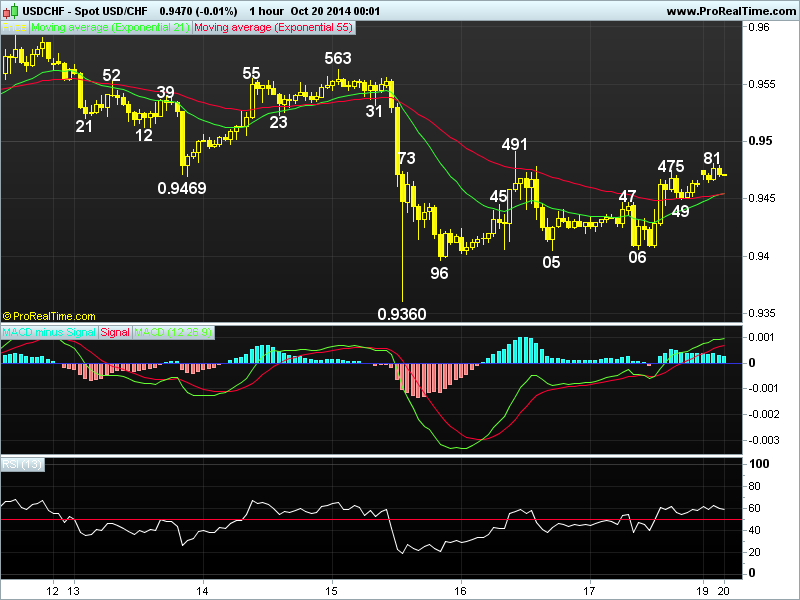

![]() AceTraderFx Mar 3: Weekly Technical Outlook on Major - USD/JPY

AceTraderFx Mar 3: Weekly Technical Outlook on Major - USD/JPY WEEKLY USD/JPY TECHNICAL OUTLOOK

WEEKLY USD/JPY TECHNICAL OUTLOOK

03 Mar 2014 00:47GMT

Trend Daily Chart

Sideways

Daily Indicators

Falling

21 HR EMA

101.76

55 HR EMA

101.95

Trend Hourly Chart

Down

Hourly Indicators

Oversold

13 HR RSI

30

14 HR DMI

-ve

Daily Analysis

Consolidation with downside bias

Resistance

102.83 - Feb 21 high

102.30 - Fri's high

101.72 - Thur's low (now res)

Support

101.27 - Intra-day low

100.76 - Feb 04 low

100.19 - 61.8% r of 96.94-105.45

. USD/JPY - 101.37... Although the greenback traded sideways initially last

Mon, price weakened to 102.01 on Tue b4 staging a rebound to 102.61 Wed. Renewed

selling there on risk aversion pressured the pair lower to 101.55 on Fri, then

to 101.27 in Australia today due heightened political tension in Ukraine.

. Looking at the hourly n daily charts, intra-day break of key sup at 101.38

confirms the correction fm Feb's 10-week low at 100.76 has ended at 102.83 (Feb

21) n as price is trading below 21h n 55h EMAs, consolidation with downside bias

remains for erratic decline fm Jan's 5-year peak at 105.45 to resume n yield re-

test of aforesaid low, break wud retain bearishness for further weakness twds

100.19, being the 'dynamic' 61.8% r of the rise fm 96.94 to 105.45. However, as

hourly oscillators wud be in o/sold territory on such move, sharp fall below

there is unlikely to be seen n psychological sup at 100.00 shud hold n yield strg

rebound later this week.

. Today, in view of abv analysis n continued political tensions in Ukraine,

selling on recovery is the way to go. Only a daily close abv 102.30 wud abort

bearish scenario n risk gain twds 102.61/68 but 102.83 shud hold initially..png)

Posted by: acetraderforex Mar 4, 2014, 09:25 AM

![]() AceTraderFx Mar 4: Daily Technical Outlook on Major USD/CHF

AceTraderFx Mar 4: Daily Technical Outlook on Major USD/CHF  DAILY USD/CHF TECHNICAL OUTLOOK

DAILY USD/CHF TECHNICAL OUTLOOK

04 Mar 2014 01:08GMT

Trend Daily Chart

Down

Daily Indicators

Falling

21 HR EMA

0.8820

55 HR EMA

0.8829

Trend Hourly Chart

Sideways

Hourly Indicators

Rising

13 HR RSI

60

14 HR DMI

+ve

Daily Analysis

Choppy trading to continue

Resistance

0.8930 - Last Wed's high

0.8889 - Last Fri's high

0.8850 - Last Mon's low (now sup)

Support

0.8777 - Last Fri's fresh 2-year low

0.8742 - 100% proj. of 0.9038-0.8850 fm 0.8930

0.8674 - .618 ext. of 09156-0.8904 fm 0.9082

. USD/CHF - 0.8805... Dlr found support after a brief selloff fm 0.8809 to

0.8783 in Aust. on Mon on short-covering in eur/chf cross n price later edged

higher to 0.8812 in early Europe n continued to strengthen after release of

upbeat U.S. eco. data, posting session high at 0.8836 in NY afternoon.

. Looking at the hourly n daily charts, dlr's rebound to 0.8836 suggests

1-2 days of choppy trading abv last Fri's fresh 2-year bottom at 0.8777 wud be

seen b4 MT downtrend fm 0.9972 (2012 top) resumes for a re-test of said sup. A

stronger recovery twd 0.8854, being the 'natural' 50% r of intermediate fall fm

0.8930-0.8777, cannot be ruled out, however, reckon chart res at 0.8889 (last

Fri's high) wud hold n downside bias remains for another fall later. Looking

ahead, a breach of 0.8777 wud confirm aforesaid decline to correct early LT

uptrend fm 2011 record low at 0.7072 has resumed n price shud en route to 0.86