Printable Version of Topic

Click here to view this topic in its original format

InstaForex | Forex Forum | Forex world | InstaForex Forum _ Economic News _ Daily reviews by BJF Trading Group

Posted by: MDunleavy Aug 4, 2009, 10:05 PM

Did Tuesday's mixed US data stop the dollar's plunge in its tracks,

or was it the more thematic risk appetite influence once again?

I think the answer is not nobody knows.

[The U.S. Dollar Index

Posted by: MDunleavy Aug 14, 2009, 12:56 PM

The U.S. Dollar Index

Posted by: MDunleavy Aug 26, 2009, 09:43 AM

The US Dollar looks to be forming a bottom against most major currencies. Although confirmation

is yet to be seen, accumulating evidence is hinting at a reversal of recent rallies in the

Euro, the British Pound as well as the Australian and New Zealand Dollars. [dailyfx]

========

Remind:The U.S. Dollar Index

Posted by: MDunleavy Sep 2, 2009, 05:17 PM

Daily Report: Dollar and Yen to Strengthen Further, Focus on Eurozone GDP and US ADP

(The U.S. Dollar Index

Posted by: MDunleavy Sep 3, 2009, 04:52 PM

At this point, intraday bias in GBP/USD remains mildly on the upside. As discussed before, a short term bottom is in place at 1.6111 with bullish convergence condition in 4 hours MACD. Hence further rise could still be seen. Nevertheless, upside should be limited below 1.6622 resistance and bring resumption of fall from 1.7043. Below 1.6235 will flip intraday bias back to the downside first and break of 1.6111 will target 1.5983 key support next.[actionforex]

P&F GBPUSD30 Box Size 30X3 or(0.54%) HI/LO

Data 1.7031 - 1.6118 ~ 1.5 Month ~ 43.48 Day

Database 1500 records 1.63481 (Last Close)

2009-07-22 05~00

2009-09-03 16~30 (GMT+01:00) Paris

BJF Trading Group

1.7040|~3O|||_________X_________________________|0.01%|5.75%

1.7040|~3O|||=========X=========================|0.01%|5.75%

1.7010|~6O|||_________XOXO______________________|0.19%|5.57%

1.6980|~9O|||_______X_XOXO______________________|0.36%|5.38%

1.6950|~12O||_______XOXO_O______________________|0.54%|5.19%

1.6920|~15O||_______XOX__O______________________|0.72%|5.01%

1.6890|~18O||_______XO___O______________________|0.89%|4.82%

1.6860|~21O||_______X____O______________________|1.07%|4.64%

1.6830|~24O||_______X____O______________________|1.24%|4.45%

1.6800|~27O||=======X====OX=====================|1.42%|4.26%

1.6770|~3OO||_______X____OXO____________________|1.6%|4.08%

1.6740|~33O||_______X____OXO____________________|1.77%|3.89%

1.6710|~36O||_______X____OXO____________________|1.95%|3.71%

1.6680|~39O||_______X____O_O____________________|2.12%|3.52%

1.6650|~42O||=======X======O==X=================|2.3%|3.33%

1.6620|~45O||_______X______O__XO______X_________|2.48%|3.15%

1.6590|~48O||_______X______O__XOX_X_X_XO________|2.65%|2.96%

1.6560|~51O||_X_____X______O__XOXOXOXOXO________|2.83%|2.77%

1.6530|~54O||_XOX___X______OX_XOXOXOXOXO________|3%|2.59%

1.6500|~57O||_XOXO__X______OXOXO_OXOXOXO________|3.18%|2.4%

1.6470|~6OO||_XOXO__X______OXOX__OXOXOXO________|3.36%|2.22%

1.6440|~63O||_XOXOX_X______OXO___OXOXO_OX_______|3.53%|2.03%

1.6410|~66O||=XO=OXOX======O=====OXOX==OXO====X=|3.71%|1.84%

1.6380|~69O||OX__OXOX____________OXO___OXOX___X_|3.88%|1.66%

1.6350|~72O||OX__O_O_____________OX____O_OXOX_X_|4.06%|1.47%

1.6320|~75O||O___________________OX______OXOXOX_|4.24%|1.28%

1.6290|~78O||____________________O_______OXOXOX_|4.41%|1.1%

1.6260|~81O||____________________________OXOXOX_|4.59%|0.91%

1.6230|~84O||____________________________OXOXOX_|4.76%|0.73%

1.6200|~87O||____________________________OXO_OX_|4.94%|0.54%

1.6170|~9OO||____________________________O___OX_|5.12%|0.35%

1.6140|~93O||================================O==|5.29%|0.17%

1.6110|~96O||___________________________________|5.47%|-0.02%

Column|~99O||3854633235321414375311775693976579_|

Count||||||||_______1____2_3_____OO_____________|

Posted by: MDunleavy Sep 4, 2009, 09:36 AM

USD/CAD once again fails below 1.1123 resistance and retreated. Break of 1.1004 minor support turns intraday outlook neutral again. On the downside, further break of 1.0870 minor support will flip intraday bias back to the downside for 1.0718 support. As noted before, break there will indicate that price actions from 1.0631 are merely consolidation in the larger decline, which is still in progress for another low below 1.0631 before completion. On the upside, break of 1.1123 resistance will confirm that whole rally from 1.0631 has resumed and affirm the case that USD/CAD has indeed bottomed out already. In such case, stronger rise should be seen to 1.1723 resistance next.[actionforex]

Trade Idea: Buy UsdCad

P&F USDCAD5 Box Size 10X3 or(0.27%) HI/LO

Data 1.1101 - 1.0791 ~ 0 Month ~ 7.27 Day

Database 1508 records 1.10269 (Last Close)

2009-08-28 00~50

2009-09-04 07~25 (GMT+01:00) Paris

BJF Trading Group

1.1100|~2O|||=====================X===========|0.01%|2.86%

1.1090|~3O|||_______X_____________XoX_________|0.1%|2.77%

1.1080|~4O|||_______Xo____________XoXo________|0.19%|2.68%

1.1070|~5O|||_______Xo____________XoXoX_X_X___|0.28%|2.59%

1.1060|~6O|||_______Xo__________X_XoXoXoXoXo__|0.37%|2.49%

1.1050|~7O|||_______Xo________X_XoXo_oXoXoXoX_|0.46%|2.4%

1.1040|~8O|||_______Xo________XoXoX__oXoXo_oXo|0.55%|2.31%

1.1030|~9O|||_______Xo________XoXoX__o_oX__oXo|0.64%|2.21%

1.1020|~1OO||=======Xo========Xo=oX====oX==o=o|0.73%|2.12%

1.1010|~11O||_______XoX_______X__o_____oX_____|0.82%|2.03%

1.1000|~12O||_______XoXo______X________oX_____|0.91%|1.94%

1.0990|~13O||_______XoXo____X_X________oX_____|1%|1.84%

1.0980|~14O||_______Xo_o____XoX________oX_____|1.09%|1.75%

1.0970|~15O||=======X==oX=X=XoX========o======|1.18%|1.66%

1.0960|~16O||_______X__oXoXoXoX_______________|1.27%|1.57%

1.0950|~17O||_____X_X__oXoXoXoX_______________|1.36%|1.47%

1.0940|~18O||_____XoX__o_oXo_oX_______________|1.45%|1.38%

1.0930|~19O||___X_XoX____oX__oX_______________|1.54%|1.29%

1.0920|~2OO||___XoXoX____oX__oX_______________|1.63%|1.2%

1.0910|~21O||___XoXo_____oX__o________________|1.72%|1.1%

1.0900|~22O||___Xo_______oX___________________|1.81%|1.01%

1.0890|~23O||___X________oX___________________|1.9%|0.92%

1.0880|~24O||o==X========o====================|1.99%|0.82%

1.0870|~25O||o__X_____________________________|2.08%|0.73%

1.0860|~26O||o__X_____________________________|2.17%|0.64%

1.0850|~27O||oX_X_____________________________|2.26%|0.55%

1.0840|~28O||oXoX_____________________________|2.35%|0.45%

1.0830|~29O||oXoX_____________________________|2.44%|0.36%

1.0820|~3OO||oXoX_____________________________|2.53%|0.27%

1.0810|~31O||oXo______________________________|2.62%|0.18%

1.0800|~32O||o================================|2.71%|0.08%

1.0790|~33O||_________________________________|2.8%|-0.01%

Column|~34O||954135411373993581345954641133533|

Count|~35O|||___2___81________4________OO_____|

http://iticsoftware.com/postimages/2009-Jun-19/usdcad040909.png http://iticsoftware.com/postimages/2009-Jun-19/cadusdPDF040909.pdf PDF

Posted by: MDunleavy Sep 16, 2009, 07:24 PM

Mid-Day Report: Dollar Soft after Making New Low

Dollar remains pressured after making new low against Euro, Yen and Aussie today. Economic data released from US provide little support to the greenback. Dollar index continue to hover around today's low of 76.20. Stocks open high on further rebound in commodities which saw the CRB index pressing 259 level. Gold remains firm after climbing to as high as 1023.3 earlier today. The Japanese yen also strengthened broadly after Hiroshia Fuji, the next finance chief in Japan, said today that he didn't support a "weaker yen". [actionforex]

P&F _DXY60 Box Size 16X3 or(0.61%) HI/LO

Data 80.95 - 76.15 ~ 3 Month ~ 91.25 Day

Database 1501 records 76.27 (Last Close)

2009-06-17 13~00

2009-09-16 19~00 (GMT+01:00) Paris

BJF Trading Group

80.96|~16|||___________________________________|-0.01%|6.32%

80.80|~32|||___XoX_____X_X_____________________|0.19%|6.11%

80.64|~48|||oX_XoXo____XoXo____________________|0.38%|5.9%

80.48|~64|||oXoXoXo____XoXoX___________________|0.58%|5.69%

80.32|~8O|||oXoXoXo__X_XoXoXo__________________|0.78%|5.48%

80.16|~96|||o_oXoXoX_XoXo_oXo__________________|0.98%|5.27%

80.00|~112||__o_oXoXoXoX__oXo__________________|1.17%|5.06%

79.84|~128||____oXoXoXoX__o_o__________________|1.37%|4.85%

79.68|~144||____o_o_oXoX____o__________________|1.57%|4.64%

79.52|~16O||________o_o_____o__X_______________|1.77%|4.43%

79.36|~176||________________o__XoX_X___________|1.96%|4.22%

79.20|~192||________________o__XoXoXo__________|2.16%|4.01%

79.04|~2O8||________________oX_XoXoXo__________|2.36%|3.8%

78.88|~224||________________oXoXoXoXo____X_____|2.56%|3.59%

78.72|~24O||________________oXoXoXoXoX___Xo____|2.75%|3.37%

78.56|~256||________________o_oXoXoXoXoX_XoX___|2.95%|3.16%

78.40|~272||__________________o_oXoXoXoXoXoXo__|3.15%|2.95%

78.24|~288||____________________oXo_oXoXoXoXo__|3.35%|2.74%

78.08|~3O4||____________________oX__oXoXo_o_o__|3.55%|2.53%

77.92|~32O||____________________oX__o_o_____o__|3.74%|2.32%

77.76|~336||____________________oX__________o__|3.94%|2.11%

77.60|~352||____________________oX__________o__|4.14%|1.9%

77.44|~368||____________________o___________o__|4.34%|1.69%

77.28|~384||________________________________o__|4.53%|1.48%

77.12|~4OO||________________________________o__|4.73%|1.27%

76.96|~416||________________________________oX_|4.93%|1.06%

76.80|~432||________________________________oXo|5.13%|0.85%

76.64|~448||________________________________oXo|5.32%|0.64%

76.48|~464||________________________________o_o|5.52%|0.43%

76.32|~48O||__________________________________o|5.72%|0.22%

76.16|~496||__________________________________o|5.92%|0.01%

76.00|~512||___________________________________|6.11%|-0.2%

Column||||||43458773455844641347117795543553135|

Count|||||||________________2___32__________3__|

http://iticsoftware.com/postimages/2009-Jul-01/dxy160909.PNG

Posted by: MDunleavy Sep 21, 2009, 09:27 PM

EUR/USD's break of 1.4640 minor support indicates that a short term top should be in place at 1.4765 on bearish divergence conditions in 4 hours MACD and RSI. Intraday bias remains mildly on the downside and further pull back should be seen towards 1.4500 support and possibly below. On the upside, above 1.4765 will indicate that pull back has completed and recent rally has resumed. Nevertheless, we'll continue to look for further loss of momentum and reversal signal as EUR/USD approaches 1.4867 key resistance level.[actionforex]

P&F EURUSD1440 Box Size 1450X3 or(3.14%) HI/LO

Data 1.6038 - 1.1639 ~ 69 Month ~ 2107 Day

Database 1500 records 1.46751 (Last Close)

2003-12-15 00~00

2009-09-21 00~00 (GMT+01:00) Paris

http://iticsoftware.com

1.6095|~145||_________________________________________|-0.36%|38.29%

1.5950|~29O||__________________X___X__________________|0.55%|37.04%

1.5805|~435||________________X_XoX_Xo_________________|1.45%|35.79%

1.5660|~58O||________________XoXoXoXo_________________|2.36%|34.55%

1.5515|~725||________________XoXoXoXo_________________|3.26%|33.3%

1.5370|~87O||________________Xo_o_o_o_________________|4.17%|32.06%

1.5225|~1O15|________________X______o_________________|5.07%|30.81%

1.5080|~116O|________________X______o_________________|5.97%|29.56%

1.4935|~13O5|____________X_X_X______o_________________|6.88%|28.32%

1.4790|~145O|____________XoXoX______oX________________|7.78%|27.07%

1.4645|~1595|============XoXoX======oXo======X=======X|8.69%|25.83%

1.4500|~174O|____________XoXo_______oXo______Xo______X|9.59%|24.58%

1.4355|~1885|____________Xo_________oXo______Xo______X|10.49%|23.34%

1.4210|~2O3O|____________X__________oXo______Xo____X_X|11.4%|22.09%

1.4065|~2175|____________X__________oXo______Xo____XoX|12.3%|20.84%

1.3920|~232O|____________X__________o_o______Xo____XoX|13.21%|19.6%

1.3775|~2465|____________X____________o______XoX___Xo_|14.11%|18.35%

1.3630|~261O|__X_________X____________o______XoXoX_X__|15.01%|17.11%

1.3485|~2755|__Xo________X____________o______XoXoXoX__|15.92%|15.86%

1.3340|~29OO|__XoX_____X_X____________o______Xo_oXoX__|16.82%|14.61%

1.3195|~3O45|__XoXo____XoX____________oX_____X__oXoX__|17.73%|13.37%

1.3050|~319O|__XoXo____XoX____________oXoX_X_X__oXoX__|18.63%|12.12%

1.2905|~3335|X_XoXo__X_Xo_____________oXoXoXoX__oXo___|19.53%|10.88%

1.2760|~348O|XoXo_o__XoX______________oXoXoXoX__oX____|20.44%|9.63%

1.2615|~3625|XoX__o__XoX______________oXo_oXo___oX____|21.34%|8.39%

1.2470|~377O|XoX__oX_Xo_______________o___o_____o_____|22.25%|7.14%

1.2325|~3915|_oX__oXoX________________________________|23.15%|5.89%

1.2180|~4O6O|_oX__oXoX________________________________|24.06%|4.65%

1.2035|~42O5|_oX__oXoX________________________________|24.96%|3.4%

1.1890|~435O|_o___o_oX________________________________|25.86%|2.16%

1.1745|~4495|_______o_________________________________|26.77%|0.91%

1.1600|~464O|_________________________________________|27.67%|-0.34%

Column|~4785|47164145836314439344334161543443193985936|

Count|~||||||__2__O______4__________4_6______4________|

http://iticsoftware.com/postimages/2009-Aug-03/eurusd210909.PNG

Posted by: MDunleavy Sep 21, 2009, 09:33 PM

Outlook in GBP/JPY remains unchanged. Intraday bias remains on the downside with 151.16 minor resistance intact and further fall should be seen to 146.75 cluster support next (38.2% retracement of 118.81 to 163.05 at 146.15). Break there will confirm that a medium term top is formed at 163.05 and will bring deeper fall to 61.8% retracement at 135.70 next. On the upside, above 151.16 minor resistance will argue that some more consolidation could be seen before fall resumption. In such case, GBP/JPY might rebound to 153.22 and above but upside is still expected to be limited below 157.47 resistance.[actionforex]

P&F GBPJPY5 Box Size 12X4 or(0.32%) HI/LO

Data 151.718 - 148.038 ~ 0 Month ~ 6.23 Day

Database 1207 records 149.38 (Last Close)

2009-09-15 09~40

2009-09-21 15~10 (GMT+01:00) Paris

http://iticsoftware.com

151.68|~12|||__x_________________________________________________|0.03%|2.46%

151.56|~24|||__x_o_______________________________________________|0.1%|2.38%

151.44|~36|||__x_o_______________________________________________|0.18%|2.3%

151.32|~48|||__x_o_______________________________________________|0.26%|2.22%

151.20|~6O|||__x_o_______________________________________________|0.34%|2.14%

151.08|~72|||____o_________________________x___x_________________|0.42%|2.05%

150.96|~84|||____o_________________________x_o_x_o_______________|0.5%|1.97%

150.84|~96|||____o_________________________x_o_x_o_x_____________|0.58%|1.89%

150.72|~1O8||____o_________________________x_o_x_o_x_o___________|0.66%|1.81%

150.60|~12O||____o_x_______________________x_o_x_o_x_o___________|0.74%|1.73%

150.48|~132||____o_x_o_____________x___x___x_o___o_x_o___________|0.82%|1.65%

150.36|~144||____o_x_o_____________x_o_x_o_x_____o___o___________|0.9%|1.57%

150.24|~156||____o_x_o_x___________x_o_x_o_x_________o___________|0.97%|1.49%

150.12|~168||____o___o_x_o_________x_o_x_o_x_________o___________|1.05%|1.41%

150.00|~18O||________o_x_o_________x_o_x_o_x_________o___________|1.13%|1.33%

149.88|~192||________o_x_o_________x_o_x_o_x_________o___________|1.21%|1.24%

149.76|~2O4||________o_x_o_________x_o_x_o_x_________o___________|1.29%|1.16%

149.64|~216||________o_x_o_________x_o___o___________o___________|1.37%|1.08%

149.52|~228||________o___o_________x_________________o___________|1.45%|1%

149.40|~24O||============o=========x=================o=x=======x=|1.53%|0.92%

149.28|~252||____________o_____x___x_________________o_x_o_____x_|1.61%|0.84%

149.16|~264||____________o_x___x_o_x_________________o_x_o_____x_|1.69%|0.76%

149.04|~276||____________o_x_o_x_o_x_________________o_x_o_x___x_|1.77%|0.68%

148.92|~288||____________o_x_o_x_o_x_________________o_x_o_x_o_x_|1.84%|0.6%

148.80|~3OO||____________o_x_o_x_o___________________o_x_o_x_o_x_|1.92%|0.51%

148.68|~312||____________o___o_______________________o___o_x_o_x_|2%|0.43%

148.56|~324||____________________________________________o_x_o___|2.08%|0.35%

148.44|~336||____________________________________________o_x_____|2.16%|0.27%

148.32|~348||____________________________________________o_x_____|2.24%|0.19%

148.20|~36O||____________________________________________o_x_____|2.32%|0.11%

148.08|~372||____________________________________________o_______|2.4%|0.03%

147.96|~384||____________________________________________________|2.48%|-0.05%

Column|~396||0_5_134_9_6_134_4_5_4_147_7_7_125_5_6_4_186_118_4_7_|

Count

http://iticsoftware.com/postimages/2009-Jun-19/gbpjpy210909.PNG

http://iticsoftware.com/postimages/2009-Jun-19/File%D0%97%D0%92%D0%90gbpjpy2109.pdf PDF

Posted by: MDunleavy Sep 25, 2009, 10:54 AM

GBP/JPY falls further to as low as 144.31 so far and at this point, intraday bias remains on the downside for deeper decline. The break of 146.75 support confirms a medium term reversal pattern and GBP/JPY should now be targeting 50% retracement of 118.81 to 163.05 at 140.93 next. On the upside, above 146.26 minor resistance will turn intraday outlook neutral and bring consolidation. But recovery should be limited below 150.35 resistance and bring fall resumption.[actionforex]

"P&F GBPJPY5 Box Size 20X3 or(0.41%) HI/LO

Data 150.354 - 144.325 ~ 0 Month ~ 7.25 Day

Database 1502 records 145.096 (Last Close)

2009-09-18 04~50

2009-09-25 10~55 (GMT+01:00) Paris

http://iticsoftware.com"

150.40|~2O|||______________________________|-0.03%|4.21%

150.20|~4O|||______________x_o_____________|0.1%|4.07%

150.00|~6O|||______________x_o_____________|0.24%|3.93%

149.80|~8O|||______________x_o_____________|0.37%|3.79%

149.60|~1OO||______________x_o_____________|0.5%|3.65%

149.40|~12O||o_x___x___x___x_o_____________|0.63%|3.52%

149.20|~14O||o_x_o_x_o_x_o_x_o_____________|0.77%|3.38%

149.00|~16O||o_x_o_x_o_x_o_x_o_____________|0.9%|3.24%

148.80|~18O||o_x_o_x_o_x_o_x_o_____________|1.03%|3.1%

148.60|~2OO||o___o_x_o___o_x_o_____________|1.17%|2.96%

148.40|~22O||____o_x_____o___o_____________|1.3%|2.82%

148.20|~24O||____o___________o_____________|1.43%|2.68%

148.00|~26O||________________o_____________|1.57%|2.55%

147.80|~28O||________________o_____________|1.7%|2.41%

147.60|~3OO||________________o_____________|1.83%|2.27%

147.40|~32O||________________o_____________|1.96%|2.13%

147.20|~34O||________________o_x___________|2.1%|1.99%

147.00|~36O||________________o_x_o_________|2.23%|1.85%

146.80|~38O||________________o_x_o_________|2.36%|1.71%

146.60|~4OO||________________o_x_o_________|2.5%|1.58%

146.40|~42O||________________o___o_________|2.63%|1.44%

146.20|~44O||____________________o_________|2.76%|1.3%

146.00|~46O||____________________o_________|2.9%|1.16%

145.80|~48O||____________________o_________|3.03%|1.02%

145.60|~5OO||____________________o_________|3.16%|0.88%

145.40|~52O||____________________o_____x___|3.29%|0.74%

145.20|~54O||____________________o_x___x_o_|3.43%|0.61%

145.00|~56O||____________________o_x_o_x_o_|3.56%|0.47%

144.80|~58O||____________________o_x_o_x_o_|3.69%|0.33%

144.60|~6OO||____________________o_x_o_x___|3.83%|0.19%

144.40|~62O||____________________o___o_____|3.96%|0.05%

144.20|~64O||______________________________|4.09%|-0.09%

Column|~66O||5_4_6_6_4_4_5_9_20_4_14_4_4_5_3_|

Count|~68O||5_4_6_6_4_4_5_9_20_4_14_4_4_5_3_|

http://iticsoftware.com/postimages/2009-Jul-01/GbpJpy250909.PNG

PDF

http://iticsoftware.com/postimages/2009-Jul-01/GBPJPYpdf250909.pdf

Posted by: MDunleavy Sep 30, 2009, 09:25 PM

Crude oil inventory rose +2.8 mmb, compared with consensus of +2 mmb increase, to 338.4 mmb in the week ended September 29. The good thing is Cushing stock recorded significant drop of -1.5 mmb.

Situation in oil product stockpiles was better than previously anticipated. Gasoline inventory drew -1.66 mmb while distillate inventory gained only +0.32 mmb. Both readings beat market expectations.

WTI crude oil price changes little after the report, only edging slightly higher to 67.5 from 66.5 before the release. Investors probably need to gauge the implications of a higher crude build with lower distillate build.

Heating oil bounces to 1.71 while RBOB gasoline rises to 1.65 after the report.

Lack of positive response from investors was also driven by disappointing US employment data and Chicago PMI. ADP reported -254K decline in employment in September following a -277K drop in the prior month. The market had expected a decline of only -195K. Chicago PMI slid to 46.1 in September after reaching the expansionary territory of 50 a month ago.[oilngold]

http://iticsoftware.com/postimages/2009-Jul-01/BrocoOil300909.PNG

http://iticsoftware.com/postimages/2009-Jul-01/PDFoilBroco30909.pdf

Posted by: MDunleavy Oct 7, 2009, 07:05 AM

Dollar Index Critical Area at 75.83

Daily chart trend: Long possibilities. Main price points: 75.83. Looking for: Wave V low

Prices on the dollar index chart were recently testing the upper resistance line of a trading channel, where a possible long break-out will confirm that wave V of a black C is done. However, this is not the case yet, and as such move into much deeper levels is still possible over the coming days, especially once the current 75.83 low is taken out. In this case, we will be looking for a new wave V target somewhere around 74.00 support zone.[actionforex]

"P&F _DXY60 Box Size 20X3 or(0.77%) CLOSE

Data 80.84 - 75.92 ~ 3 Month ~ 91.25 Day

Database 1500 records 76.4 (Last Close)

2009-07-08 01~00

2009-10-07 07~00 (GMT+01:00) Paris

http://iticsoftware.com"

80.80|~2O|||o_________________________________________________________|0.05%|6.43%

80.60|~4O|||o_________________________________________________________|0.3%|6.16%

80.40|~6O|||o_x_______________________________________________________|0.54%|5.9%

80.20|~8O|||o_x_o_____________________________________________________|0.79%|5.64%

80.00|~1OO||o_x_o_____________________________________________________|1.04%|5.37%

79.80|~12O||o___o_____________________________________________________|1.29%|5.11%

79.60|~14O||____o_____x_______________________________________________|1.53%|4.85%

79.40|~16O||____o_____x_o_____x_______________________________________|1.78%|4.58%

79.20|~18O||____o_____x_o_x___x_o_____________________________________|2.03%|4.32%

79.00|~2OO||____o_x___x_o_x_o_x_o_____________________________________|2.28%|4.06%

78.80|~22O||____o_x_o_x_o_x_o_x_o_x_______x___________________________|2.52%|3.79%

78.60|~24O||____o_x_o_x_o_x_o_x_o_x_o_____x_o_x_______________________|2.77%|3.53%

78.40|~26O||____o___o_x_o_x_o_x_o_x_o_x___x_o_x_o_____________________|3.02%|3.27%

78.20|~28O||________o___o_x_o___o_x_o_x_o_x_o_x_o_____________________|3.27%|3%

78.00|~3OO||____________o_x_____o_x_o_x_o_x_o___o_____________________|3.51%|2.74%

77.80|~32O||============o=x=====o===o===o=======o=====================|3.76%|2.48%

77.60|~34O||____________o_x_____________________o_____________________|4.01%|2.21%

77.40|~36O||____________o_______________________o_____________________|4.26%|1.95%

77.20|~38O||____________________________________o_____________x___x___|4.5%|1.69%

77.00|~4OO||____________________________________o_x___x___x___x_o_x_o_|4.75%|1.42%

76.80|~42O||____________________________________o_x_o_x_o_x_o_x_o_x_o_|5%|1.16%

76.60|~44O||____________________________________o_x_o_x_o_x_o_x_o_x_o_|5.24%|0.9%

76.40|~46O||____________________________________o___o_x_o_x_o___10__o_|5.49%|0.63%

76.20|~48O||________________________________________o_x_o_x_________o_|5.74%|0.37%

76.00|~5OO||========================================o===o=x=========o=|5.99%|0.11%

75.80|~52O||____________________________________________o_____________|6.23%|-0.16%

Column|~54O|6_3_103_4_7_119_5_6_8_5_5_3_3_5_4_3_113_5_5_6_6_3_4_4_4_6_|

Count

Posted by: MDunleavy Oct 20, 2009, 09:52 PM

Forex market volatility expectations have gained considerably through the past week

Posted by: MDunleavy Oct 21, 2009, 11:22 AM

"P&F _DXY 1 min Box Size 25X4 or(0.13%) CLOSE

Data 75.76 - 75.11 ~ 0 Month ~ 2.07 Day

Database 2093 records 75.38 (Last Close)

2009-10-19 08~33

2009-10-21 10~08 (GMT+01:00) Paris

http://iticsoftware.com chart"

75.75|~3||||==============================x===========|0.01%|0.85%

75.73|~6||||______________________________x_o_x_______|0.05%|0.82%

75.70|~9||||______________________________x_o_x_o_x___|0.08%|0.79%

75.68|~12|||______________________________x_o_x_o_x_o_|0.11%|0.75%

75.65|~15|||______________________________x_o_x_o_x_o_|0.15%|0.72%

75.63|~18|||__________x___________________x_o_x_o_x_o_|0.18%|0.69%

75.60|~21|||o_________x_o_________________x_o___o_x_o_|0.21%|0.65%

75.58|~24|||o_____x___x_o_________________x_____o_x_o_|0.24%|0.62%

75.55|~27|||o_____x_o_x_o_________________x_____o_x_o_|0.28%|0.59%

75.53|~3O|||o_____x_o_x_o_________________x_____o_x_o_|0.31%|0.55%

75.50|~33|||o_x___x_o_x_o_________________x_____o_x_o_|0.34%|0.52%

75.48|~36|||o=x=o=x=o===o=================x=====o===o=|0.38%|0.49%

75.45|~39|||o_x_o_x_____o_________________x_________o_|0.41%|0.45%

75.43|~42|||o_x_o_x_____o_________________x_________o_|0.44%|0.42%

75.40|~45|||o===o=======o=x===============x=========o=|0.48%|0.39%

75.38|~48|||____________o_x_o_x___________x_________o_|0.51%|0.35%

75.35|~51|||____________o_x_o_x_o_________x_________o_|0.54%|0.32%

75.33|~54|||____________o_x_o_x_o_________x_________o_|0.57%|0.29%

75.30|~57|||____________o_x_o_x_o_x_______x___________|0.61%|0.25%

75.28|~6O|||============o===o===o=x=o=x===x===========|0.64%|0.22%

75.25|~63|||____________________o_x_o_x_o_x___________|0.67%|0.19%

75.23|~66|||____________________o_x_o_x_o_x___________|0.71%|0.15%

75.20|~69|||____________________o_x_o_x_o_x___________|0.74%|0.12%

75.18|~72|||____________________o_x_o___o_x___________|0.77%|0.09%

75.15|~75|||____________________o_x_____o_x___________|0.81%|0.05%

75.13|~78|||____________________o_x_____o_____________|0.84%|0.02%

75.10|~81|||====================o=====================|0.87%|-0.01%

Column|~84||9_4_4_7_4_6_145_5_4_118_5_4_6_256_5_109_15|

Count

http://iticsoftware.com/postimages/2009-Aug-03/091021DXYMix.PNG

http://iticsoftware.com/postimages/2009-Aug-03/Excel_USD_Index.zip

"P&F _DXY1 Box Size 25X4 or(0.13%) CLOSE

Data 75.76 - 74.95 ~ 0 Month ~ 2.07 Day

Database 2106 records 74.99 (Last Close)

2009-10-19 18~01

2009-10-21 19~43 (GMT+01:00) Paris

BJF Trading Group"

75.78|~3||||________________________________________________|-0.02%|1.1%

75.75|~6||||________________x_______________________________|0.01%|1.07%

75.73|~9||||________________x_o_x___________________________|0.05%|1.03%

75.70|~12|||________________x_o_x_o_x_______________________|0.08%|1%

75.68|~15|||________________x_o_x_o_x_o_____________________|0.11%|0.97%

75.65|~18|||________________x_o_x_o_x_o_____________________|0.15%|0.93%

75.63|~21|||________________x_o_x_o_x_o_____________________|0.18%|0.9%

75.60|~24|||________________x_o___o_x_o_____________________|0.21%|0.87%

75.58|~27|||________________x_____o_x_o_____x_______________|0.24%|0.83%

75.55|~3O|||________________x_____o_x_o_____x_o_____________|0.28%|0.8%

75.53|~33|||________________x_____o_x_o_____x_o_____________|0.31%|0.77%

75.50|~36|||________________x_____o_x_o_x___x_o_____________|0.34%|0.73%

75.48|~39|||________________x_____o___o_x_o_x_o_____________|0.38%|0.7%

75.45|~42|||________________x_________o_x_o_x_o_____________|0.41%|0.67%

75.43|~45|||________________x_________o_x_o_x_o_____________|0.44%|0.63%

75.40|~48|||________________x_________o_x_o_x_o_____________|0.48%|0.6%

75.38|~51|||x_______________x_________o_x_o___o_____________|0.51%|0.57%

75.35|~54|||x_o_____________x_________o_x_____o_____________|0.54%|0.53%

75.33|~57|||x_o_____________x_________o_______o_____________|0.57%|0.5%

75.30|~6O|||x_o_x___________x_________________o_____________|0.61%|0.47%

75.28|~63|||__o_x_o_x_______x_________________o_____________|0.64%|0.43%

75.25|~66|||__o_x_o_x_o_____x_________________o_____________|0.67%|0.4%

75.23|~69|||__o_x_o_x_o_x___x_________________o_x___________|0.71%|0.37%

75.20|~72|||__o_x_o_x_o_x_o_x_________________o_x_o_________|0.74%|0.33%

75.18|~75|||__o_x_o___o_x_o_x_________________o_x_o_x_______|0.77%|0.3%

75.15|~78|||__o_x_____o_x_o_x_________________o_x_o_x_o_x___|0.81%|0.27%

75.13|~81|||__o_x_____o___o___________________o___o_x_o_x_o_|0.84%|0.23%

75.10|~84|||__o___________________________________o_x_o_x_o_|0.87%|0.2%

75.08|~87|||______________________________________o_x_o_x_o_|0.9%|0.17%

75.05|~9O|||======================================o===o===o=|0.94%|0.13%

75.03|~93|||______________________________________________o_|0.97%|0.1%

75.00|~96|||______________________________________________o_|1%|0.07%

74.98|~99|||______________________________________________o_|1.04%|0.03%

74.95|~1O2||______________________________________________o_|1.07%|0%

Column||||||4_1185_4_6_4_4_256_5_109_15_7_5_8_184_7_5_5_4_8_|

Count

Posted by: MDunleavy Oct 23, 2009, 06:40 PM

As noted before, while further rise to 100% projection of 1.4177 to 1.4842 from 1.4483 at

1.5148 cannot be ruled out, upside would likely be limited there and bring pull back. Below

1.4884 minor support will indicate that a short term top should at least be formed with bearish

divergence conditions in 4 hours MACD and RSI. Deeper decline should be seen to 1.4483 support

in this case.

In the bigger picture, the strong break of 1.4867 resistance argues that whole fall from 1.6039

has completed at 1.2329 already and rise from there is still in progress. At this point, there

is no sign of topping yet and the current rally could extend further for retesting 1.6039 high.

Nevertheless, as we're not seeing a clear impulsive structure in the current rally, we'd expect

upside to be limited there and bring another medium term fall to continue the wide range

consolidation from from 1.6039. On the downside, break of 1.4483 support will be the first sign

that rise from 1.2456 has completed. Further break of 1.3747 support will confirm and turn

focus back to 1.2329/2456 support zone.[actionforex]

"P&F EURUSD1440 Box Size 150X3 or(3.25%) HI/LO

Data 1.6038 - 1.1639 ~ 48 Month ~ 1477 Day

Database 1050 records 1.50189 (Last Close)

2005-10-07 00~00

2009-10-23 00~00 (GMT+01:00) Paris

http://iticsoftware.com"

1.6050|~15O||____________________________________________________________|-0.07%|37.9%

1.5900|~3OO||__________________x___x___x_________________________________|0.86%|36.61%

1.5750|~45O||__________________x_o_x_o_x_o_______________________________|1.8%|35.32%

1.5600|~6OO||__________________x_o_x_o_x_o_______________________________|2.73%|34.03%

1.5450|~75O||__________________x_o___o_x_o_______________________________|3.67%|32.74%

1.5300|~9OO||__________________x_____o___o_______________________________|4.6%|31.45%

1.5150|~1O5O|__________________x_________o_______________________________|5.54%|30.17%

1.5000|~12OO|__________________x_________o_____________________________x_|6.47%|28.88%

1.4850|~135O|==========x===x===x=========o=x===========================x=|7.41%|27.59%

1.4700|~15OO|__________x_o_x_o_x_________o_x_o_____________x___________x_|8.34%|26.3%

1.4550|~165O|__________x_o_x_o_x_________o_x_o_____________x_o_________x_|9.28%|25.01%

1.4400|~18OO|__________x_o___o___________o_x_o_____________x_o_________x_|10.21%|23.72%

1.4250|~195O|__________x_________________o_x_o_____________x_o_____x___x_|11.15%|22.43%

1.4100|~21OO|__________x_________________o_x_o_____________x_o_____x_o_x_|12.08%|21.14%

1.3950|~225O|__________x_________________o___o_____________x_o_____x_o_x_|13.02%|19.86%

1.3800|~24OO|__________x_____________________o_____________x_o_____x_o___|13.95%|18.57%

1.3650|~255O|__________x_____________________o_____________x_o_x___x_____|14.89%|17.28%

1.3500|~27OO|__________x_____________________o_____________x_o_x_o_x_____|15.82%|15.99%

1.3350|~285O|______x___x_____________________o_____________x_o_x_o_x_____|16.76%|14.7%

1.3200|~3OOO|______x_o_x_____________________o_x___________x_o_x_o_x_____|17.7%|13.41%

1.3050|~315O|______x_o_x_____________________o_x_o_x___x___x_o_x_o_x_____|18.63%|12.12%

1.2900|~33OO|______x_o_______________________o_x_o_x_o_x_o_x_o_x_o_______|19.57%|10.83%

1.2750|~345O|______x_________________________o_x_o_x_o_x_o_x_o_x_________|20.5%|9.55%

1.2600|~36OO|______x_________________________o_x_o___o_x_o___o___________|21.44%|8.26%

1.2450|~375O|______x_________________________o_______o___________________|22.37%|6.97%

1.2300|~39OO|__x___x_____________________________________________________|23.31%|5.68%

1.2150|~4O5O|__x_o_x_____________________________________________________|24.24%|4.39%

1.2000|~42OO|o_x_o_x_____________________________________________________|25.18%|3.1%

1.1850|~435O|o_x_o_______________________________________________________|26.11%|1.81%

1.1700|~45OO|o___________________________________________________________|27.05%|0.52%

1.1550|~465O|____________________________________________________________|27.98%|-0.76%

Column|~48OO|3_4_3_103_133_3_3_103_3_4_4_136_165_4_3_4_4_3_14147_5_9_3_8_|

Count

http://iticsoftware.com/postimages/2009-Aug-03/091023EurUsd.PNG

http://iticsoftware.com/postimages/2009-Aug-03/Excel_EurUsd_091023.zip

Posted by: MDunleavy Nov 5, 2009, 02:18 PM

Since April, the value of the U.S. dollar (USD) has steadily lost value against the Japanese yen (JPY). Across the Asia Pacific, the USD/JPY cross rate remains a key barometer of a two-way play of global economic fundamentals and risk aversion.

This barometer has experienced many high and low points in the last 26 months. In June 2007, the USD/JPY traded a five-year high of 124.16 to the USD. As far as the fundamentals were concerned, that five-year high was more about a weaker yen, than a stronger U.S. dollar. Over these 26 months, through better and worse, USD/JPY has declined as the yen has appreciated 25 percent against the U.S. dollar.

This 25 percent decline in USD/JPY is illustrated in Chart 1, with the initial change of trend signal appearing soon after the USD/JPY five-year high in June 2007. The red line over the price bars illustrate the MACD predictor (referred to as DiNapoliMP or

Posted by: MDunleavy Nov 14, 2009, 02:17 PM

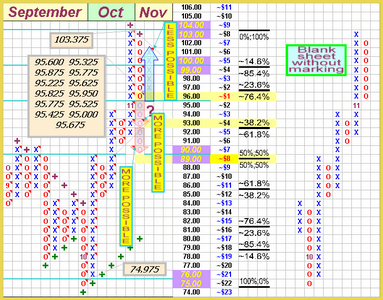

Current development argues that a short term top is at least formed at 1123.4, with mild bearish divergence condition in 4 hours MACD, after Gold hits upper channel resistance. Intraday bias is now mildly on the downside for 4 hours 55 EMA (now at 1095.4 first. Sustained trading below will target a test on the lower channel support (now at 1053.2). On the upside, however, above 1123.4 again will indicate that recent rally is still in progress for 61.8% projection of 681 to 1007.7 from 931.3 at 1133.2.

In the bigger picture, the long term up trend in Gold is still in progress. Rise from 681 would likely develop into another set of five wave sequence with first wave completed at 1007.7, second wave triangle consolidation completed at 931.3. Rise from 931.3 is expected to extend to 61.8% projection of 681 to 1007.7 from 931.3 at 1133.2 first and then 100% projection at 1258 next. On the downside, break of 1026.9 support will suggest that a top is formed and bring consolidation. But we'll hold on to the bullish view as long as 931.3 key support holds.[oilngold]

"P&F GOLD30 Box Size500X3 or(1.42%) HI/LO

Data 1122.7 - 984.99 ~ 2 Month ~ 58.6 Day

Database 2028 records 1118.29 (Last Close)

2009-09-16 08~00

2009-11-13 22~30 (GMT+01:00) Paris

BJF Trading Group chart"

1120.00|~5OO||________________________________x_______|0.24%|13.71%

1115.00|~1OOO|____________________________x_o_x_o_x_o_|0.69%|13.2%

1110.00|~15OO|____________________________x___x_o_x___|1.13%|12.69%

1105.00|~2OOO|____________________________x_____o_____|1.58%|12.18%

1100.00|~25OO|____________________________x___________|2.02%|11.68%

1095.00|~3OOO|____________________________x___________|2.47%|11.17%

1090.00|~35OO|____________________________x___________|2.91%|10.66%

1085.00|~4OOO|____________________________x___________|3.36%|10.15%

1080.00|~45OO|____________________________x___________|3.8%|9.65%

1075.00|~5OOO|____________________________x___________|4.25%|9.14%

1070.00|~55OO|________________x___________x___________|4.69%|8.63%

1065.00|~6OOO|________________x_o_x___x___x___________|5.14%|8.12%

1060.00|~65OO|____________x___x_o_x_o_x_o_x___________|5.58%|7.62%

1055.00|~7OOO|____________x_o_x_o_x_o_x_o_x___________|6.03%|7.11%

1050.00|~75OO|____________x_o_x_o_x_o___o_x___________|6.48%|6.6%

1045.00|~8OOO|____________x_o___o_______o_x___________|6.92%|6.09%

1040.00|~85OO|____________x_____________o_x___________|7.37%|5.58%

1035.00|~9OOO|____________x_____________o_x___________|7.81%|5.08%

1030.00|~95OO|____________x_____________o_____________|8.26%|4.57%

1025.00|~1OOO|____________x___________________________|8.7%|4.06%

1020.00|~1O5O|x___________x___________________________|9.15%|3.55%

1015.00|~11OO|x_o_x_______x___________________________|9.59%|3.05%

1010.00|~115O|x_o_x_o_____x___________________________|10.04%|2.54%

1005.00|~12OO|__o_x_o_x___x___________________________|10.48%|2.03%

1000.00|~125O|__o___o_x_o_x___________________________|10.93%|1.52%

995.00|~13OO||______o_x_o_x___________________________|11.37%|1.02%

990.00|~135O||______o_x_o_____________________________|11.82%|0.51%

985.00|~14OO||______o_________________________________|12.27%|0%

980.00|~145O||________________________________________|12.71%|-0.51%

Column|~15OO||3_4_3_6_4_3_143_5_5_4_3_3_7_171_3_3_2_1_|

Count

=============================

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091114gold_h4.PNG

Posted by: MDunleavy Nov 16, 2009, 01:06 PM

The estimated test of key resistance range levels has been confirmed, but relative rise in buying activity, marked by OsMA trend indicator, did not favor immediate implementation of the pre-planned short positions. Nevertheless, in the bigger picture, considering close parity of both party activity while rate is contained within the borders of Ichimoku cloud, we can assume probability of rate range movement with attainment of close border of the cloud at 1,4980/1,5000 levels, where it is recommended to evaluate the development of the activity of both parties in accordance with the charts of a shorter time interval. As for short-term sales on condition of the formation of topping signals the targets will be 1,4920/40 and (or) further break-out variant up to 1,4860/80, 1,4800/20. The alternative for buyers will be above 1,5080 with the targets of 1,5120/40, 1,5180/1,5200, 1,5240/60.[actionforex]

"P&F EURUSD1440 Box Size 150X3 or(3.25%) HI/LO

Data 1.6038 - 1.1639 ~ 49 Month ~ 1477 Day

Database 1050 records 1.4974 (Last Close)

2005-10-31 00~00

2009-11-16 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

1.6050|~15O||_____________________________|-0.07%|37.9%

1.5900|~3OO||________X_X_X________________|0.86%|36.61%

1.5750|~45O||________XoXoXo_______________|1.8%|35.32%

1.5600|~6OO||________XoXoXo_______________|2.73%|34.03%

1.5450|~75O||________Xo_oXo_______________|3.67%|32.74%

1.5300|~9OO||________X__o_o_______________|4.6%|31.45%

1.5150|~1O5O|________X____o_______________|5.54%|30.17%

1.5000|~12OO|________X____o______________X|6.47%|28.88%

1.4850|~135O|____X_X_X____oX_____________X|7.41%|27.59%

1.4700|~15OO|____XoXoX____oXo______X_____X|8.34%|26.3%

1.4550|~165O|____XoXoX____oXo______Xo____X|9.28%|25.01%

1.4400|~18OO|____Xo_o_____oXo______Xo____X|10.21%|23.72%

1.4250|~195O|____X________oXo______Xo__X_X|11.15%|22.43%

1.4100|~21OO|____X________oXo______Xo__XoX|12.08%|21.14%

1.3950|~225O|____X________o_o______Xo__XoX|13.02%|19.86%

1.3800|~24OO|____X__________o______Xo__Xo_|13.95%|18.57%

1.3650|~255O|____X__________o______XoX_X__|14.89%|17.28%

1.3500|~27OO|____X__________o______XoXoX__|15.82%|15.99%

1.3350|~285O|__X_X__________o______XoXoX__|16.76%|14.7%

1.3200|~3OOO|__XoX__________oX_____XoXoX__|17.7%|13.41%

1.3050|~315O|__XoX__________oXoX_X_XoXoX__|18.63%|12.12%

1.2900|~33OO|__Xo___________oXoXoXoXoXo___|19.57%|10.83%

1.2750|~345O|__X____________oXoXoXoXoX____|20.5%|9.55%

1.2600|~36OO|__X____________oXo_oXo_o_____|21.44%|8.26%

1.2450|~375O|__X____________o___o_________|22.37%|6.97%

1.2300|~39OO|X_X__________________________|23.31%|5.68%

1.2150|~4O5O|XoX__________________________|24.24%|4.39%

1.2000|~42OO|XoX__________________________|25.18%|3.1%

1.1850|~435O|Xo___________________________|26.11%|1.81%

1.1700|~45OO|_____________________________|27.05%|0.52%

1.1550|~465O|_____________________________|27.98%|-0.76%

Column|~48OO|43131333133441615434431175938|

Count|~495O||__O_3___O____3_6______44_____|

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091116_eurusd4H.PNG

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091116_eurusd4H.xls

Posted by: MDunleavy Nov 21, 2009, 11:59 PM

Dollar index's break of 75.76 resistance last week indicates that fall from 76.82 has completed and serves as the first indication that it has bottomed out. Focus is now on 76.82 resistance and a firm break there will affirm the bullish case by completing a double bottom reversal pattern (74.94, 74.68). Note again that such development will indicate that medium term fall from 89.62 has completed the five wave sequence already and will pave the way for strong rebound to 78.33/81.47 resistance zone at least. However, there is not confirmation of the bullish case yet. In particular, note that price actions in EUR/USD and USD/CHF are not convincingly supporting the case of reversal yet. Meanwhile, dollar index is now still limited well below 76.82. It's believed that developments in gold and US stocks will be crucial to whether dollar can finally reverse and stage a noticeable rebound.[actionforex]

"P&F _DY1440 Box Size 100X3 or(3.53%) HI/LO

Data 99.49 - 70.7 ~ 75 Month ~ 2290 Day

Database 1620 records 75.6 (Last Close)

2003-08-14 00~00

2009-11-20 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

99.00|~1OO||x___________________________________________________|0.49%|40.03%

98.00|~2OO||x_o_________________________________________________|1.5%|38.61%

97.00|~3OO||__o_________________________________________________|2.5%|37.2%

96.00|~4OO||__o_________________________________________________|3.51%|35.79%

95.00|~5OO||__o_________________________________________________|4.51%|34.37%

94.00|~6OO||__o_________________________________________________|5.52%|32.96%

93.00|~7OO||__o_________________________________________________|6.52%|31.54%

92.00|~8OO||__o_____x___________x_______________________________|7.53%|30.13%

91.00|~9OO||__o_____x_o_________x_o_x___________________________|8.53%|28.71%

90.00|~1OOO|__o_____x_o_____x___x_o_x_o_________________________|9.54%|27.3%

89.00|~11OO|__o_____x_o_____x_o_x_o_x_o_________________x_______|10.54%|25.88%

88.00|~12OO|__o_x___x_o_____x_o_x_o___o_____________x___x_o_____|11.55%|24.47%

87.00|~13OO|__o_x_o_x_o_____x_o_x_____o_x_______x___x_o_x_o_____|12.55%|23.06%

86.00|~14OO|__o_x_o_x_o_____x_o_______o_x_o_____x_o_x_o_x_o_x___|13.56%|21.64%

85.00|~15OO|==o===o===o=x===x=========o=x=o=====x=o=x=o=x=o=x=o=|14.56%|20.23%

84.00|~16OO|__________o_x_o_x_________o___o_____x_o___o_x_o_x_o_|15.57%|18.81%

83.00|~17OO|__________o_x_o_x_____________o_____x_____o_x_o___o_|16.57%|17.4%

82.00|~18OO|__________o_x_o_______________o_____x_____o_x_____o_|17.58%|15.98%

81.00|~19OO|__________o___________________o_____x_____o_x_____o_|18.58%|14.57%

80.00|~2OOO|______________________________o_x___x_____o_x_____o_|19.59%|13.15%

79.00|~21OO|______________________________o_x_o_x_____o_x_____o_|20.6%|11.74%

78.00|~22OO|______________________________o_x_o_x_____o_______o_|21.6%|10.33%

77.00|~23OO|______________________________o_x_o_x_____________o_|22.61%|8.91%

76.00|~24OO|______________________________o_x_o_______________o_|23.61%|7.5%

75.00|~25OO|==============================o=x=================o=|24.62%|6.08%

74.00|~26OO|______________________________o_x___________________|25.62%|4.67%

73.00|~27OO|______________________________o_x___________________|26.63%|3.25%

72.00|~28OO|______________________________o_x___________________|27.63%|1.84%

71.00|~29OO|______________________________o_____________________|28.64%|0.42%

70.00|~3OOO|____________________________________________________|29.64%|-0.99%

Column||||||2_143_3_7_114_3_8_4_6_4_3_7_3_169_4_113_4_10116_3_11|

Count

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-091121_dxyMix.PNG

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-091121_dxyMix.xls

Posted by: MDunleavy Nov 24, 2009, 08:02 AM

My CCI study gave us a valid signal about upside correction yesterday. Price topped at 1.6647 but failed to stay above 1.6600 area so far, keep my bearish scenario intact with technical bearish target remains at 1.6400 and 1.6250 area. The bias is neutral in nearest term but I still prefer a bearish scenario. For me only movement above 1.6692 could be a serious threat to my bearish outlook. Immediate support at 1.6550. Break below that area should trigger further bearish momentum at least towards 1.6475 area. Initial resistance at 1.6647 (yesterday's high). Break above that area should trigger further bullish momentum testing 1.6692 and should be seen as potential threat to my bearish outlook. I will be watching any reaction around those levels before make any decision today[actionforex]

"P&F GBPUSD240 Box Size 10X3 or(1.93%) HI/LO

Data 1.7042 - 1.4109 ~ 8 Month ~ 244.83 Day

Database 1050 records 1.65859 (Last Close)

2009-03-24 08~00

2009-11-24 04~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

1.7100|~1OO||____________________________|-0.34%|21.2%

1.7000|~2OO||______________X_____________|0.25%|20.49%

1.6900|~3OO||______________Xo____________|0.83%|19.78%

1.6800|~4OO||______________Xo__________X_|1.42%|19.07%

1.6700|~5OO||____________X_Xo__X_______Xo|2.01%|18.36%

1.6600|~6OO||______X_X_X_XoXoX_Xo__X_X_Xo|2.59%|17.66%

1.6500|~7OO||______XoXoXoXoXoXoXo__XoXoXo|3.18%|16.95%

1.6400|~8OO||______XoXoXoXoXoXoXo__XoXoX_|3.77%|16.24%

1.6300|~9OO||______XoXoXo_oXo_oXo__Xo_o__|4.35%|15.53%

1.6200|~1OOO|______XoXo___oX__o_o__X_____|4.94%|14.82%

1.6100|~11OO|______XoX____oX____oX_X_____|5.53%|14.11%

1.6000|~12OO|______XoX____o_____oXoX_____|6.11%|13.4%

1.5900|~13OO|______Xo___________oXoX_____|6.7%|12.69%

1.5800|~14OO|______X____________o_o______|7.29%|11.99%

1.5700|~15OO|______X_____________________|7.87%|11.28%

1.5600|~16OO|______X_____________________|8.46%|10.57%

1.5500|~17OO|______X_____________________|9.05%|9.86%

1.5400|~18OO|______X_____________________|9.64%|9.15%

1.5300|~19OO|______X_____________________|10.22%|8.44%

1.5200|~2OOO|______X_____________________|10.81%|7.73%

1.5100|~21OO|______X_____________________|11.4%|7.02%

1.5000|~22OO|____X_X_____________________|11.98%|6.32%

1.4900|~23OO|__X_XoX_____________________|12.57%|5.61%

1.4800|~24OO|__XoXoX_____________________|13.16%|4.9%

1.4700|~25OO|X_XoXoX_____________________|13.74%|4.19%

1.4600|~26OO|XoXo_oX_____________________|14.33%|3.48%

1.4500|~27OO|_oX__oX_____________________|14.92%|2.77%

1.4400|~28OO|_oX__o______________________|15.5%|2.06%

1.4300|~29OO|_oX_________________________|16.09%|1.35%

1.4200|~3OOO|_o__________________________|16.68%|0.64%

1.4100|~31OO|____________________________|17.26%|-0.06%

Column|~32OO|2573462774434717345933833353|

Count|~33OO|______2_______O_____________|

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091124_usdgbp1h.PNG

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091124_gbpusd1h.xls

Posted by: MDunleavy Nov 26, 2009, 08:58 AM

Intraday bias in EUR/CHF remains neutral for the moment. But still with 1.5102 support intact, we're favoring the bullish case that choppy fall from 1.5238 has completed at 1.5080 already. Above 1.5145 will bring rise resumption to 1.5238 resistance first. Nevertheless, break of 1.5102 minor support will dampen this immediate bullish view and indicate that another fall could still be seen to 1.5076 and below before concluding recent consolidations.

In the bigger picture, firstly, price actions from 1.5446 are treated as consolidation to rise from 1.4577 only and such rise is expected to resume sooner or later to test 1.5880 resistance. Secondly, the corrective structure of the fall from 1.5880 to 1.4577 indicates that it's a correction to medium term rise from 1.4315. Rise from 1.4577 is tentatively treated as resumption of rally from 1.4315. Hence we're expecting an eventual break of 1.5880 as rise from 1.4315 resumes. In other words, we're favoring the case that long term down trend from 1.6826 has completed at 1.4315 already. We'll hold on to this bullish view as long as 1.5007 support remains intact.[actionforex]

"P&F EURCHF1440 Box Size 80X4 or(2.06%) HI/LO

Data 1.6827 - 1.4315 ~ 48 Month ~ 1477 Day

Database 1050 records 1.50417 (Last Close)

2005-11-10 00~00

2009-11-26 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

1.6800|~8O|||____X___________________________|0.16%|17.36%

1.6720|~16O||____XoX_________________________|0.64%|16.8%

1.6640|~24O||__X_XoXo________________________|1.11%|16.24%

1.6560|~32O||__XoXoXo________________________|1.59%|15.68%

1.6480|~4OO||__XoXoXo________________________|2.06%|15.12%

1.6400|~48O||__XoXoXo________________________|2.54%|14.57%

1.6320|~56O||__XoXo_o__X_X___________________|3.01%|14.01%

1.6240|~64O||__Xo___o__XoXo__________________|3.49%|13.45%

1.6160|~72O||__X____oX_XoXo__________________|3.96%|12.89%

1.6080|~8OO||__X____oXoXoXo__________________|4.44%|12.33%

1.6000|~88O||__X____oXoXo_o__________________|4.91%|11.77%

1.5920|~96O||__X____oXoX__o__________________|5.39%|11.21%

1.5840|~1O4O|X_X____o_oX__o________X_________|5.87%|10.65%

1.5760|~112O|XoX______oX__o________Xo________|6.34%|10.09%

1.5680|~12OO|XoX______oX__o________Xo________|6.82%|9.54%

1.5600|~128O|XoX______oX__o________Xo________|7.29%|8.98%

1.5520|~136O|Xo_______oX__oX_____X_Xo________|7.77%|8.42%

1.5440|~144O|X________oX__oXo____XoXo____X___|8.24%|7.86%

1.5360|~152O|_________o___oXo____XoXo____XoX_|8.72%|7.3%

1.5280|~16OO|_____________oXo____XoXo____XoXo|9.19%|6.74%

1.5200|~168O|_____________oXo____Xo_o____XoXo|9.67%|6.18%

1.5120|~176O|_____________o_o__X_X__oX_X_XoXo|10.14%|5.62%

1.5040|~184O|_______________o__XoX__oXoXoXo_o|10.62%|5.06%

1.4960|~192O|_______________o__XoX__oXoXoX___|11.1%|4.51%

1.4880|~2OOO|_______________oX_XoX__oXoXoX___|11.57%|3.95%

1.4800|~2O8O|_______________oXoXoX__o_oXoX___|12.05%|3.39%

1.4720|~216O|_______________oXoXo_____o_oX___|12.52%|2.83%

1.4640|~224O|_______________oXoX________o____|13%|2.27%

1.4560|~232O|_______________oXo______________|13.47%|1.71%

1.4480|~24OO|_______________oX_______________|13.95%|1.15%

1.4400|~248O|_______________oX_______________|14.42%|0.59%

1.4320|~256O|_______________o________________|14.9%|0.03%

1.4240|~264O|________________________________|15.37%|-0.52%

Column|~272O|64157651411441517475148145561544|

Count|~28OO||__4____1_O2__5_5____O__3____O___|

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091126_eurchfMix.PNG

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091126_eurchfMix.xls

Posted by: Jeminy Rider Nov 27, 2009, 06:04 AM

"P&F GBPUSD240 Box Size 10X3 or(1.93%) HI/LO

Data 1.7042 - 1.4109 ~ 8 Month ~ 244.83 Day

Database 1050 records 1.65859 (Last Close)

2009-03-24 08~00

2009-11-24 04~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

1.7100|~1OO||____________________________|-0.34%|21.2%

1.7000|~2OO||______________X_____________|0.25%|20.49%

1.6900|~3OO||______________Xo____________|0.83%|19.78%

1.6800|~4OO||______________Xo__________X_|1.42%|19.07%

1.6700|~5OO||____________X_Xo__X_______Xo|2.01%|18.36%

1.6600|~6OO||______X_X_X_XoXoX_Xo__X_X_Xo|2.59%|17.66%

1.6500|~7OO||______XoXoXoXoXoXoXo__XoXoXo|3.18%|16.95%

1.6400|~8OO||______XoXoXoXoXoXoXo__XoXoX_|3.77%|16.24%

1.6300|~9OO||______XoXoXo_oXo_oXo__Xo_o__|4.35%|15.53%

1.6200|~1OOO|______XoXo___oX__o_o__X_____|4.94%|14.82%

1.6100|~11OO|______XoX____oX____oX_X_____|5.53%|14.11%

1.6000|~12OO|______XoX____o_____oXoX_____|6.11%|13.4%

1.5900|~13OO|______Xo___________oXoX_____|6.7%|12.69%

1.5800|~14OO|______X____________o_o______|7.29%|11.99%

1.5700|~15OO|______X_____________________|7.87%|11.28%

1.5600|~16OO|______X_____________________|8.46%|10.57%

1.5500|~17OO|______X_____________________|9.05%|9.86%

1.5400|~18OO|______X_____________________|9.64%|9.15%

1.5300|~19OO|______X_____________________|10.22%|8.44%

1.5200|~2OOO|______X_____________________|10.81%|7.73%

1.5100|~21OO|______X_____________________|11.4%|7.02%

1.5000|~22OO|____X_X_____________________|11.98%|6.32%

1.4900|~23OO|__X_XoX_____________________|12.57%|5.61%

1.4800|~24OO|__XoXoX_____________________|13.16%|4.9%

1.4700|~25OO|X_XoXoX_____________________|13.74%|4.19%

1.4600|~26OO|XoXo_oX_____________________|14.33%|3.48%

1.4500|~27OO|_oX__oX_____________________|14.92%|2.77%

1.4400|~28OO|_oX__o______________________|15.5%|2.06%

1.4300|~29OO|_oX_________________________|16.09%|1.35%

1.4200|~3OOO|_o__________________________|16.68%|0.64%

1.4100|~31OO|____________________________|17.26%|-0.06%

Column|~32OO|2573462774434717345933833353|

Count|~33OO|______2_______O_____________|

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091124_usdgbp1h.PNG

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-091124_gbpusd1h.xls

Really, I am very appreciate on your forex information. Thank you.

Posted by: Steven Jack Nov 27, 2009, 10:18 AM

Really, you are giving a good information. I have getting some good tips and ideas.

Posted by: MDunleavy Nov 28, 2009, 05:15 PM

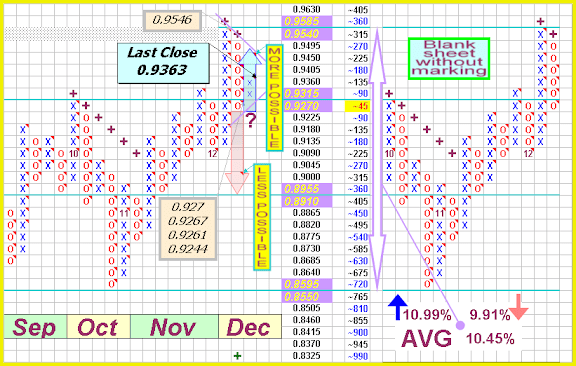

Not being able to maintain a bid-tone approaching 0.7400 - NZD is weakening again. Important support is formed by the .7200 handle but I wouldn't bet too much on how strong it will be in case of a re-test. It is worth watching it, though, as a break down may provide a good selling point - objectives into the 0.6900 - 0.7000 zone.

"P&F NZDUSD240 Box Size 90X3 or(4.31%) HI/LO

Data 0.7633 - 0.489 ~ 15 Month ~ 470.33 Day

Database 2000 records 0.71078 (Last Close)

2008-08-14 12~00

2009-11-27 20~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

0.7650|~9O|||_________________________________|-0.22%|56.44%

0.7560|~18O||_____________________________Xo__|0.96%|54.6%

0.7470|~27O||_____________________________XoX_|2.14%|52.76%

0.7380|~36O||_____________________________XoXo|3.31%|50.92%

0.7290|~45O||_____________________________XoXo|4.49%|49.08%

0.7200|~54O||_X___________________________XoXo|5.67%|47.24%

0.7110|~63O||oXo__________________________Xo_o|6.85%|45.4%

0.7020|~72O||_Xo__________________________X___|8.03%|43.56%

0.6930|~81O||__oX_________________________X___|9.21%|41.72%

0.6840|~9OO||__oXo________________________X___|10.39%|39.88%

0.6750|~99O||__oXo________________________X___|11.57%|38.04%

0.6660|~1O8O|__oXo________________________X___|12.75%|36.2%

0.6570|~117O|__oXo____________________X___X___|13.93%|34.36%

0.6480|~126O|__o_o____________________XoX_X___|15.11%|32.52%

0.6390|~135O|____o____________________XoXoX___|16.28%|30.67%

0.6300|~144O|____o__X_________________XoXoX___|17.46%|28.83%

0.6210|~153O|____oX_XoX_______________Xo_o____|18.64%|26.99%

0.6120|~162O|____oXoXoXoX___________X_X_______|19.82%|25.15%

0.6030|~171O|____oXoXoXoXo__X_______XoX_______|21%|23.31%

0.5940|~18OO|____oXo_o_oXo__XoX___X_XoX_______|22.18%|21.47%

0.5850|~189O|____o_____oXo__XoXo__XoXo________|23.36%|19.63%

0.5760|~198O|__________oXo__XoXo__XoX_________|24.54%|17.79%

0.5670|~2O7O|__________oXo__Xo_o__XoX_________|25.72%|15.95%

0.5580|~216O|__________oXoX_X__o__XoX_________|26.9%|14.11%

0.5490|~225O|__________oXoXoX__o__Xo__________|28.08%|12.27%

0.5400|~234O|__________o_oXoX__oX_X___________|29.25%|10.43%

0.5310|~243O|____________oXoX__oXoX___________|30.43%|8.59%

0.5220|~252O|____________o_o___oXoX___________|31.61%|6.75%

0.5130|~261O|__________________oXoX___________|32.79%|4.91%

0.5040|~27OO|__________________o_oX___________|33.97%|3.07%

0.4950|~279O|____________________o____________|35.15%|1.23%

0.4860|~288O|_________________________________|36.33%|-0.61%

Column|~297O|138514344398144943145157384331644|

Count|~3O6O||____2_______O_____O__1_______5___|

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-091128_NZDUSD_30min.PNG

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-091128_NZDUSD_30min.xls

Posted by: MDunleavy Dec 2, 2009, 07:26 PM

USD/CAD Daily Outlook

Intraday bias in USD/CAD remains on the downside with 1.0532 minor resistance intact. Correction from 1.0851 is still in progress for 100% projection of 1.0851 to 1.0416 from 1.0748 at 1.0313. But downside should be contained above 1.0205 low to conclude the correction. On the upside, above 1.0532 will turn intraday bias neutral first and turn focus back to 1.0748 resistance instead.[actionforex]

"P&F USDCAD1440 Box Size 225X3 or(5.38%) HI/LO

Data 1.6054 - 0.9056 ~ 91 Month ~ 2772 Day

Database 1974 records 1.05026 (Last Close)

2002-05-01 00~00

2009-12-02 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

1.6200|~225||________________________________________|-0.91%|78.89%

1.5975|~45O||x_______________________________________|0.49%|76.4%

1.5750|~675||x_o_____________________________________|1.89%|73.92%

1.5525|~9OO||x_o_____________________________________|3.3%|71.43%

1.5300|~1125|x_o_____________________________________|4.7%|68.95%

1.5075|~135O|__o_____________________________________|6.1%|66.46%

1.4850|~1575|__o_____________________________________|7.5%|63.98%

1.4625|~18OO|__o_____________________________________|8.9%|61.5%

1.4400|~2O25|__o_____________________________________|10.3%|59.01%

1.4175|~225O|__o_x___________________________________|11.7%|56.53%

1.3950|~2475|__o_x_o_x_______________________________|13.11%|54.04%

1.3725|~27OO|__o_x_o_x_o_____________________________|14.51%|51.56%

1.3500|~2925|__o___o_x_o_____________________________|15.91%|49.07%

1.3275|~315O|______o_x_o_____________________________|17.31%|46.59%

1.3050|~3375|______o_x_o_____________________x_______|18.71%|44.1%

1.2825|~36OO|______o___o_________x___x___x___x_o_____|20.11%|41.62%

1.2600|~3825|__________o_x_______x_o_x_o_x_o_x_o_____|21.51%|39.13%

1.2375|~4O5O|__________o_x_o_____x_o_x_o_x_o_x_o_____|22.92%|36.65%

1.2150|~4275|__________o_x_o_____x_o_x_o___o_x_o_____|24.32%|34.17%

1.1925|~45OO|__________o___o_____x_o_x_____o___o_____|25.72%|31.68%

1.1700|~4725|______________o_x___x_o_x_________o_x___|27.12%|29.2%

1.1475|~495O|______________o_x_o_x_o___________o_x_o_|28.52%|26.71%

1.1250|~5175|______________o_x_o_x_____________o_x_o_|29.92%|24.23%

1.1025|~54OO|______________o___o_x_____________o_x_o_|31.33%|21.74%

1.0800|~5625|__________________o_x_____________o___o_|32.73%|19.26%

1.0575|~585O|__________________o_x_________________o_|34.13%|16.77%

1.0350|~6O75|__________________o_x_________________o_|35.53%|14.29%

1.0125|~63OO|__________________o_x___________________|36.93%|11.8%

0.9900|~6525|__________________o_x___________________|38.33%|9.32%

0.9675|~675O|__________________o_x___________________|39.73%|6.84%

0.9450|~6975|__________________o_x___________________|41.14%|4.35%

0.9225|~72OO|__________________o_____________________|42.54%|1.87%

0.9000|~7425|________________________________________|43.94%|-0.62%

Column|~765O|4_113_6_5_9_3_7_3_11166_6_3_3_4_5_104_6_|

Count

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-USDCAD_H4and30min.PNG

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-USDCAD_H4and30min.xls

Posted by: MDunleavy Dec 11, 2009, 07:00 AM

The Support at 0.9100 mentioned earlier held during the day and Aussie is continuing to trade higher. We may expect a test of the Resistance at 0.9200. As mentioned earlier a break above 0.9200 might see a rise towards 0.9280-0.9300. As the pair is looking strong on its upmove, we expect the Support at 0.9100 to hold in the US session also. However, a break below 0.9100 might pull it down towards 0.9020-00. Overall we expect it to trade in the range of 0.9000-0.9300 for some time.[actionforex]

"P&F AUDUSD1440 Box Size 150X3 or(5.97%) HI/LO

Data 0.9849 - 0.5228 ~ 92 Month ~ 2808 Day

Database 2000 records 0.91427 (Last Close)

2002-04-03 00~00

2009-12-10 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

0.9750|~15O||__________________________________|1.01%|86.5%

0.9600|~3OO||_______________Xo_________________|2.53%|83.63%

0.9450|~45O||_____________X_Xo_________________|4.05%|80.76%

0.9300|~6OO||___________X_XoXo________________X|5.57%|77.89%

0.9150|~75O||___________XoXoXo________________X|7.1%|75.02%

0.9000|~9OO||___________XoXo_o________________X|8.62%|72.15%

0.8850|~1O5O|_________X_XoX__o________________X|10.14%|69.28%

0.8700|~12OO|_________XoXoX__o________________X|11.67%|66.41%

0.8550|~135O|_________XoXo___o________________X|13.19%|63.54%

0.8400|~15OO|_________XoX____oX_______________X|14.71%|60.67%

0.8250|~165O|_________XoX____oXo____________X_X|16.24%|57.8%

0.8100|~18OO|_________XoX____oXo____________XoX|17.76%|54.93%

0.7950|~195O|___X___X_XoX____o_o____________XoX|19.28%|52.07%

0.7800|~21OO|___Xo__XoXo_______o____________Xo_|20.8%|49.2%

0.7650|~225O|___Xo__XoX________o____________X__|22.33%|46.33%

0.7500|~24OO|___Xo__XoX________o____________X__|23.85%|43.46%

0.7350|~255O|___XoX_XoX________o____________X__|25.37%|40.59%

0.7200|~27OO|___XoXoXoX________o__X_____X___X__|26.9%|37.72%

0.7050|~285O|___XoXoXo_________oX_XoX___Xo__X__|28.42%|34.85%

0.6900|~3OOO|___Xo_o___________oXoXoXoX_Xo__X__|29.94%|31.98%

0.6750|~315O|___X______________oXoXoXoXoXoX_X__|31.47%|29.11%

0.6600|~33OO|___X______________oXoXo_oXoXoXoX__|32.99%|26.24%

0.6450|~345O|___X______________o_o___oXoXoXoX__|34.51%|23.37%

0.6300|~36OO|___X____________________oXoXo_o___|36.03%|20.5%

0.6150|~375O|___X____________________o_o_______|37.56%|17.64%

0.6000|~39OO|___X______________________________|39.08%|14.77%

0.5850|~4O5O|___X______________________________|40.6%|11.9%

0.5700|~42OO|_X_X______________________________|42.13%|9.03%

0.5550|~435O|_XoX______________________________|43.65%|6.16%

0.5400|~45OO|oXoX______________________________|45.17%|3.29%

0.5250|~465O|__o_______________________________|46.7%|0.42%

Column|||||||1331733761715634131445436557633131|

Count||||||||___8_____2_O____2_3____________3_O|

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-AUDUSD_h430min_091210.PNG

http://iticsoftware.com/postimages/2009-Jul-01/BJF-Trading-Group-AUDUSD_h430min_091210.xls

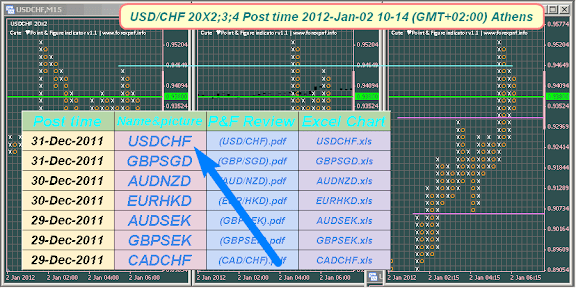

Posted by: MDunleavy Dec 12, 2009, 09:38 AM

Although the single currency rebounded strongly from 126.95 to 134.54, the sharp retreat from there to 128.78 suggests further choppy consolidation would take place and as long as 128.78 holds, mild upside bias is seen for another bounce to 132.34 (61.8% Fibonacci retracement of 134.54 to 128.78) but break of 134.54 resistance is needed to add credence to our recent preferred count that the wave 2 from 139.26 was a triple threes. This abc-x-abc-x-abc is labeled as: first set of a-b-c ended at 127.00, then x wave at 138.72, followed by second set of a-b-c at 129.02, then another x wave at 138.49 with the third set of a-b-c marked as: a-131.01, b-135.75 and the c leg as well as entire wave 2 ended at 126.95.

Our preferred count remains that the upmove from 112.08 is wave 1 of C has ended at 139.26 with minor wave iii ended at 137.42, followed by triangle wave iv at 126.98, then the move from there to 127.00 is wave 2 with the latest break-down indicated above and consolidation with upside bias remains for another test of 134.54 and possibly to 135.00. Looking ahead, only breach of 135.76-136.00 resistance area would add credence to this count and signal wave 2 has indeed ended at 126.95, then headway to 137.00 and later test of resistance at 138.49 would follow.[actionforex]

"P&F EURJPY240 Box Size 160X4 or(4.68%) HI/LO

Data 161.65 - 112.072 ~ 16 Month ~ 470.33 Day

Database 2000 records 130.378 (Last Close)

2008-08-28 12~00

2009-12-11 20~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

161.60|~16O||____________________________|0.03%|44.19%

160.00|~32O||o___________________________|1.02%|42.77%

158.40|~48O||o___________________________|2.01%|41.34%

156.80|~64O||oX__________________________|3%|39.91%

155.20|~8OO||oXo_________________________|3.99%|38.48%

153.60|~96O||oXo_________________________|4.98%|37.05%

152.00|~112O|oXo_________________________|5.97%|35.63%

150.40|~128O|oXo_________________________|6.96%|34.2%

148.80|~144O|oXo_________________________|7.95%|32.77%

147.20|~16OO|o_o_________________________|8.94%|31.34%

145.60|~176O|__o_________________________|9.93%|29.92%

144.00|~192O|__o_________________________|10.92%|28.49%

142.40|~2O8O|__o_________________________|11.91%|27.06%

140.80|~224O|__oX________________________|12.9%|25.63%

139.20|~24OO|==oXo================X======|13.89%|24.21%

137.60|~256O|__oXo________________XoX_X__|14.88%|22.78%

136.00|~272O|__oXo____________X___XoXoXo_|15.87%|21.35%

134.40|~288O|__oXo__________X_XoX_XoXoXoX|16.86%|19.92%

132.80|~3O4O|__o_o__________XoXoXoXoXoXoX|17.85%|18.5%

131.20|~32OO|____o__________XoXoXoXoXoXoX|18.84%|17.07%

129.60|~336O|____oX_X_____X_XoXoXoXoXo_oX|19.83%|15.64%

128.00|~352O|====oXoXo====XoXoXoXo=o===o=|20.82%|14.21%

126.40|~368O|____oXoXo____XoXo_oX________|21.81%|12.78%

124.80|~384O|____oXoXoX_X_XoX__o_________|22.8%|11.36%

123.20|~4OOO|____oXo_oXoXoXoX____________|23.79%|9.93%

121.60|~416O|____oX__oXoXoXoX____________|24.78%|8.5%

120.00|~432O|____oX__oXoXoXoX____________|25.77%|7.07%

118.40|~448O|____oX__o_oXoXoX____________|26.76%|5.65%

116.80|~464O|____oX____o_o_oX____________|27.75%|4.22%

115.20|~48OO|____o_________oX____________|28.73%|2.79%

113.60|~496O|______________o_____________|29.72%|1.36%

112.00|~512O|____________________________|30.71%|-0.06%

Column|~528O|9615194474555811567647765564|

Count|~544O||__5_6_________O3____________|

http://iticsoftware.com/postimages/2009-Jun-19/BJF-Trading-Group-EURJPY_4h30min_91211.PNG

http://iticsoftware.com/postimages/2009-Jun-19/BJF-Trading-Group-EURJPY_4h30min_91211.xls

Posted by: MDunleavy Dec 13, 2009, 06:49 PM

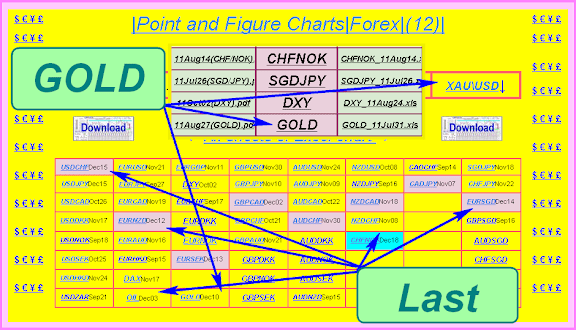

European debt concerns will subside, eventually

The past week started off with a Fitch ratings downgrade of Greece followed by S&P moving Spain's credit outlook to negative, though its ratings were affirmed. The moves rattled investors' nerves and weighed on the EUR and other European currencies. The financial media filed the obligatory 'risk of a sovereign debt default' and the 'euro could come undone' stories, adding to concerns on Europe. However, we think the ratings moves are simply a short-term blow to sentiment which dovetailed nicely with the Euro cresting at the beginning of December. There is little immediate concern of a debt default as seen in Greek government debt yields, which while about 2% higher than German yields, are not in panic territory at about 5.2%. Indeed, should the worst come to pass it would likely only be later next year and lead to a rescue package from the IMF or the EU. European leaders were consistent in admonishing the most deficit-heavy countries to address budget issues urgently, and leaders of those nations' seemed to get the message, but they also indicated that they would mutually address any terminal credit crisis. As for the fate of the EUR, there is zero chance of EMU coming undone or Greece being thrown overboard, given treaty obligations. In that sense, the impact on the EUR is largely psychological, but that doesn't mean it can't weigh on the common currency further, which is why we also see scope for further EUR weakness ahead. We think fears may begin to subside in the New Year as investors conclude the risks are overblown and assets get put back to work in the new calendar year.[Written by Forex.com]

EUR Index

"P&F EUR_Day_MIX Box Size 48X3 or(1.44%) CLOSE

Data 107.357 - 92.9315 ~ 49 Month ~ 1477 Day

Database 1050 records 100 (Last Close)

2005-11-25 00~00

2009-12-11 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

107.52|~48||______________________________________________________|-0.15%|15.7%

107.04|~96||______________________________x___x___________________|0.3%|15.18%

106.56|~144|______________________________x_o_x_o_________________|0.74%|14.67%

106.08|~192|______________________________x_o_x_o_________________|1.19%|14.15%

105.60|~24O|______________________________x_o___o_________________|1.64%|13.63%

105.12|~288|______________________________x_____o_________________|2.08%|13.12%

104.64|~336|______________________________x_____o_________________|2.53%|12.6%

104.16|~384|______________________________x_____o_x_______________|2.98%|12.08%

103.68|~432|______________________________x_____o_x_o_____________|3.43%|11.57%

103.20|~48O|______________x_______________x_____o_x_o_____________|3.87%|11.05%

102.72|~528|__________x___x_o_____________x_____o_x_o_____________|4.32%|10.53%

102.24|~576|__________x_o_x_o_____________x_____o_x_o_x___x_______|4.77%|10.02%

101.76|~624|__________x_o_x_o_____x___x___x_____o_x_o_x_o_x_o_____|5.21%|9.5%

101.28|~672|__________x_o_x_o_x___x_o_x_o_x_____o_x_o_x_o_x_o_x___|5.66%|8.98%

100.80|~72O|__________x_o___o_x_o_x_o_x_o_x_____o_x_o_x_o___o_x_o_|6.11%|8.47%

100.32|~768|______x___x_____o_x_o_x_o_x_o_x_____o_x_o_______o_x_o_|6.55%|7.95%

99.84|~816||______x_o_x_____o___o_x_o_x_o_______o___________o___o_|7%|7.43%

99.36|~864||______x_o_x_________o_x_o_x___________________________|7.45%|6.92%

98.88|~912||______x_o_x_________o___o_x___________________________|7.9%|6.4%

98.40|~96O||__x___x_o_______________o_x___________________________|8.34%|5.88%

97.92|~1OO8|__x_o_x_________________o_x___________________________|8.79%|5.37%

97.44|~1O56|__x_o_x_________________o_____________________________|9.24%|4.85%

96.96|~11O4|__x_o_________________________________________________|9.68%|4.33%

96.48|~1152|__x___________________________________________________|10.13%|3.82%

96.00|~12OO|__x___________________________________________________|10.58%|3.3%

95.52|~1248|__x___________________________________________________|11.03%|2.79%

95.04|~1296|__x___________________________________________________|11.47%|2.27%

94.56|~1344|__x___________________________________________________|11.92%|1.75%

94.08|~1392|__x___________________________________________________|12.37%|1.24%

93.60|~144O|o_x___________________________________________________|12.81%|0.72%

93.12|~1488|o_x___________________________________________________|13.26%|0.2%

92.64|~1536|o_____________________________________________________|13.71%|-0.31%

Column||||||3_123_7_4_9_4_5_7_3_5_6_9_9_4_153_3_159_8_4_3_3_5_3_3_|

Count

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-EurIndex_091212.PNG

http://iticsoftware.com/postimages/2009-Aug-03/BJF-Trading-Group-EurIndex_091212.xls

Posted by: MDunleavy Dec 16, 2009, 03:16 PM

Intraday bias in GBP/USD remains neutral for the moment as sideway trading from 1.6166 continues. Another rise cannot be ruled out but still, upside is expected to be limited well below 1.6515 resistance and bring fall resumption. Below 1.6166 will indicate that whole fall from 1.6875 has resumed and should target a retest of 1.5706 support next.[actionforex]

"P&F GBPUSD1440 Box Size 250X3 or(4.33%) HI/LO

Data 2.1161 - 1.3502 ~ 92 Month ~ 2795 Day

Database 2000 records 1.63294 (Last Close)

2002-04-22 00~00

2009-12-16 00~00 (GMT+01:00) Paris

http://iticsoftware.com chart"

2.1250|~25O||____________________________________|-0.42%|57.38%

2.1000|~5OO||_________________X__________________|0.76%|55.53%

2.0750|~75O||_________________Xo_________________|1.94%|53.68%

2.0500|~1OOO|_______________X_Xo_________________|3.12%|51.83%

2.0250|~125O|_______________XoXoX________________|4.31%|49.98%

2.0000|~15OO|_______________XoXoXo_______________|5.49%|48.13%

1.9750|~175O|_______________Xo_oXo_______________|6.67%|46.27%

1.9500|~2OOO|_________X_____X__o_o_______________|7.85%|44.42%

1.9250|~225O|_________Xo____X____o_______________|9.03%|42.57%

1.9000|~25OO|_____X___Xo__X_X____o_______________|10.21%|40.72%

1.8750|~275O|_____XoX_Xo__XoX____o_______________|11.39%|38.87%

1.8500|~3OOO|_____XoXoXo__XoX____oX______________|12.58%|37.02%

1.8250|~325O|_____XoXoXoX_Xo_____oXo_____________|13.76%|35.17%

1.8000|~35OO|_____XoXoXoXoX______oXo_____________|14.94%|33.31%

1.7750|~375O|_____XoXo_oXoX______oXo_____________|16.12%|31.46%

1.7500|~4OOO|_____Xo___o_oX______o_o_____________|17.3%|29.61%

1.7250|~425O|_____X______o_________o_____________|18.48%|27.76%

1.7000|~45OO|_____X________________o__________X__|19.66%|25.91%

1.6750|~475O|===X=X================o==========XoX|20.84%|24.06%

1.6500|~5OOO|_X_XoX________________oX_________XoX|22.03%|22.2%

1.6250|~525O|_XoXoX________________oXo________XoX|23.21%|20.35%

1.6000|~55OO|=XoXoX================oXo========XoX|24.39%|18.5%

1.5750|~575O|_XoXo_________________oXo________Xo_|25.57%|16.65%

1.5500|~6OOO|_Xo___________________o_oX_X_____X__|26.75%|14.8%

1.5250|~625O|_X______________________oXoXoX___X__|27.93%|12.95%

1.5000|~65OO|_X______________________oXoXoXo__X__|29.11%|11.09%

1.4750|~675O|_X______________________o_oXoXoX_X__|30.3%|9.24%

1.4500|~7OOO|oX________________________o_o_oXoX__|31.48%|7.39%

1.4250|~725O|______________________________oXoX__|32.66%|5.54%

1.4000|~75OO|______________________________oXoX__|33.84%|3.69%

1.3750|~775O|______________________________o_o___|35.02%|1.84%

1.3500|~8OOO|____________________________________|36.2%|-0.01%

Column|~825O|194541654783473935631414734443644154|

Count|~85OO||_____3______________1_2__________3__|

http://iticsoftware.com/postimages/2009-Jun-19/BJF-Trading-Group-GBPUSD_4h30min_091216.PNG

http://iticsoftware.com/postimages/2009-Jun-19/BJF-Trading-Group-GBPUSD_4h30min_091216.xls

Posted by: MDunleavy Dec 21, 2009, 12:54 PM

GBP/JPY's recovery extended further to as high as 146.89 last week. But after all, it's still limited by 147.43 resistance and we're holding on to the bearish view. That is, choppy recovery from 141.99 is treated as correction to fall from 149.15 only. A break below 143.12 minor support will suggest that such recovery is completed and will flip intraday bias back to the downside. Further break of 141.99 will target 139.26 support next. However, note that break of 147.43 will dampen this immediate bearish view and suggest that rise from 139.26 is still in progress for another high above 149.15 before completion.[actionforex]

"P&F GBPJPY1440 Box Size 440X3 or(7.08%) HI/LO